In contrast to other digital wallets, Google Pay allows users to send and receive money, and payments can be obtained directly into bank accounts. Therefore, there is no longer any concern about receiving money in wallets and transferring it to a bank account. It’s interesting to note that receiving payments doesn’t require using the Google Pay app. Even on their website, Google Pay makes money transfers simpler. Although the app’s primary purpose is to enable straightforward money transfer transactions, it also allows users to make purchases at merchants that accept UPI-based transactions.

1. Created By Google

This app was explicitly created for India. It is unique because Google supports it. Google has benefited from its technological prowess and financial might. Because of Google, you would discover some distinctive features in the Tez. To make this app safe, Google has offered the unique Tez shield.

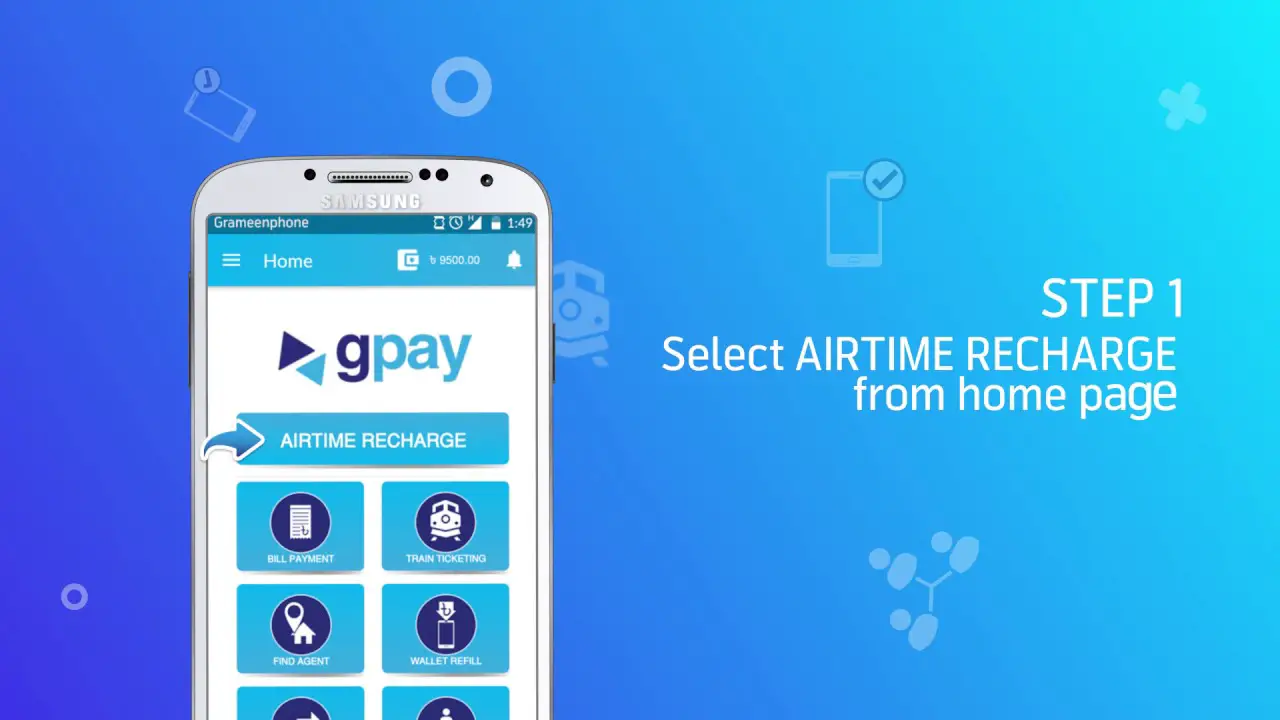

2. Mobile Recharge

The Google Pay (Tez) service can be used to recharge a mobile phone as well. The Tez itself contains a complete list of telecom company’s plans. The process of recharging a mobile device is rapid and easy, just like all the other features. It is simple to repeat a recharge through the Tez because no additional information is needed. Simply tapping on the previous transaction, you can choose the same recharge amount.

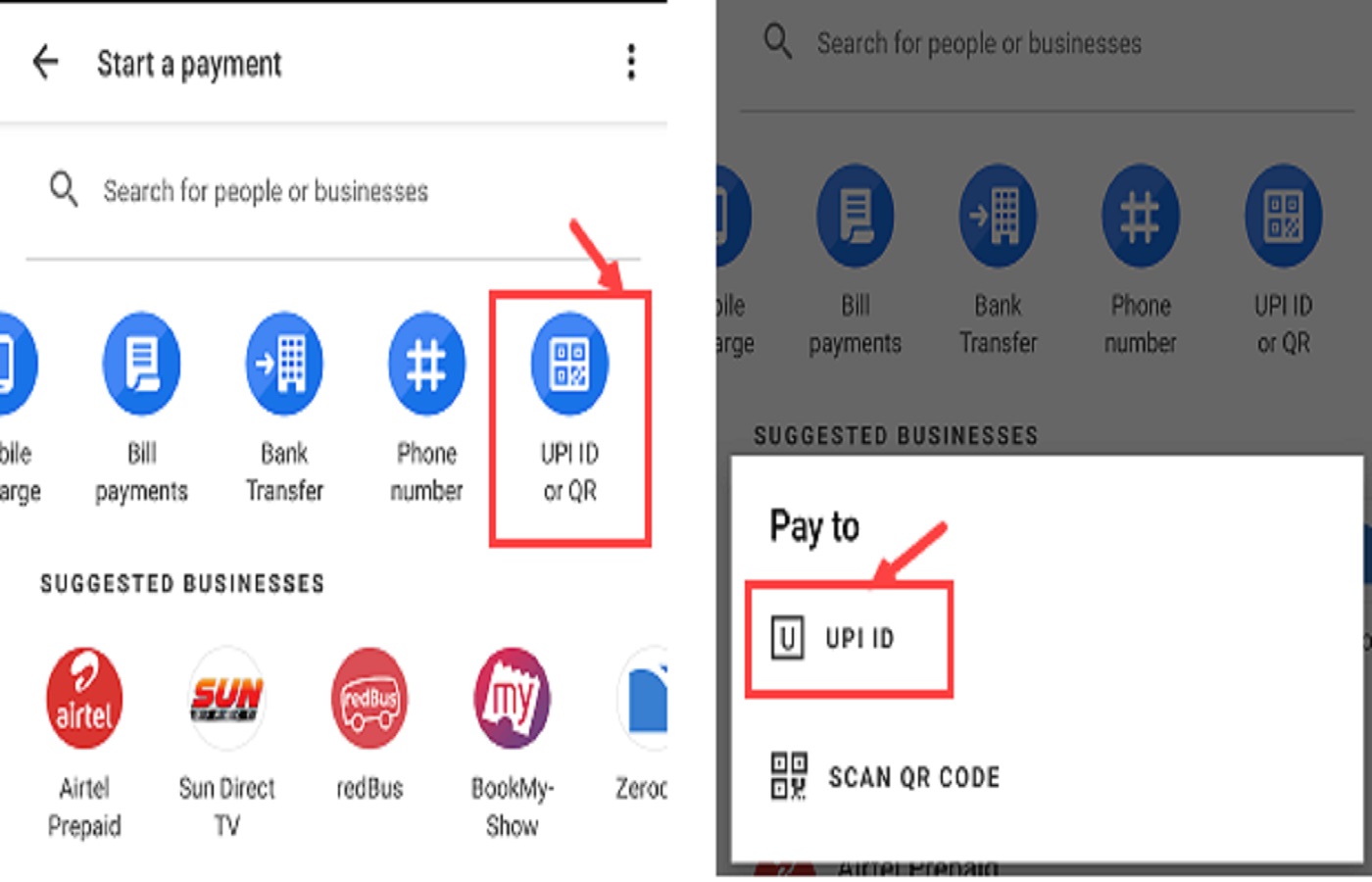

3. Based On UPI

The UPI Payments system is the foundation of the Tez app. As a result, this app includes all of UPI’s features. As you may already be aware, the NPCI developed the UPI payment interface. Instantaneous fund transfers between two accounts are made possible by this system. The possession of a bank account is not a required number to use this system. The mobile numbers connected to the bank accounts are used by this system. Additionally, funds are moved between bank accounts. The apps only serve as a conduit. To a bank account, money can be transferred instantly. This system is operational 365 days a year, 24 hours a day. Therefore, there is no chance of a delay. Similar functionality is provided by the IMPS payment system, but NEFT and RTGS are not always available. Money is not immediately transferred via NEFT. The market is filled with UPI-based applications. Nearly all banks have UPI-based mobile apps. Such as PNB UPI, SBI Pay, etc. However, Paytm, Phonepe, Freecharge, and Tez are the most well-known brands.

4. Request Money

There is a feature that all UPI apps share. Both sending and receiving money are possible. Both parties must use a UPI app to use the Ask money feature. You must know the Payer’s UPI ID (VPA) to use the Ask Money or Request Money feature. The requested feature informs the payer based on UPI ID. By entering the UPI PIN after seeing the notification of the Fund request, the payer can approve this payment.

5. Many Banks Accounts

You can choose to link several bank accounts with Tez. Multiple bank accounts can be used with this one app. However, you can only set one bank account as the default at a time. Your default bank account, however, can be changed at any time. Please note that you must create a unique UPI PIN for each bank account. To verify, it is required.

6. Cash Mode For Nearby People

Gmail Pay (Tez) Mode Tez The “CashMode” is a unique feature of Google Pay (Tez). With this method, transferring money to those in the area is simple. You are not required to enter any Payee information in this mode. Whether it be a mobile number, bank account number, or UPI ID, you would be able to recognize the nearby people on your Tez screen when using the cash mode. It is comparable to selecting a Wi-Fi network or Bluetooth gadget. For this kind of transfer, Google is utilizing sound recognition technology.

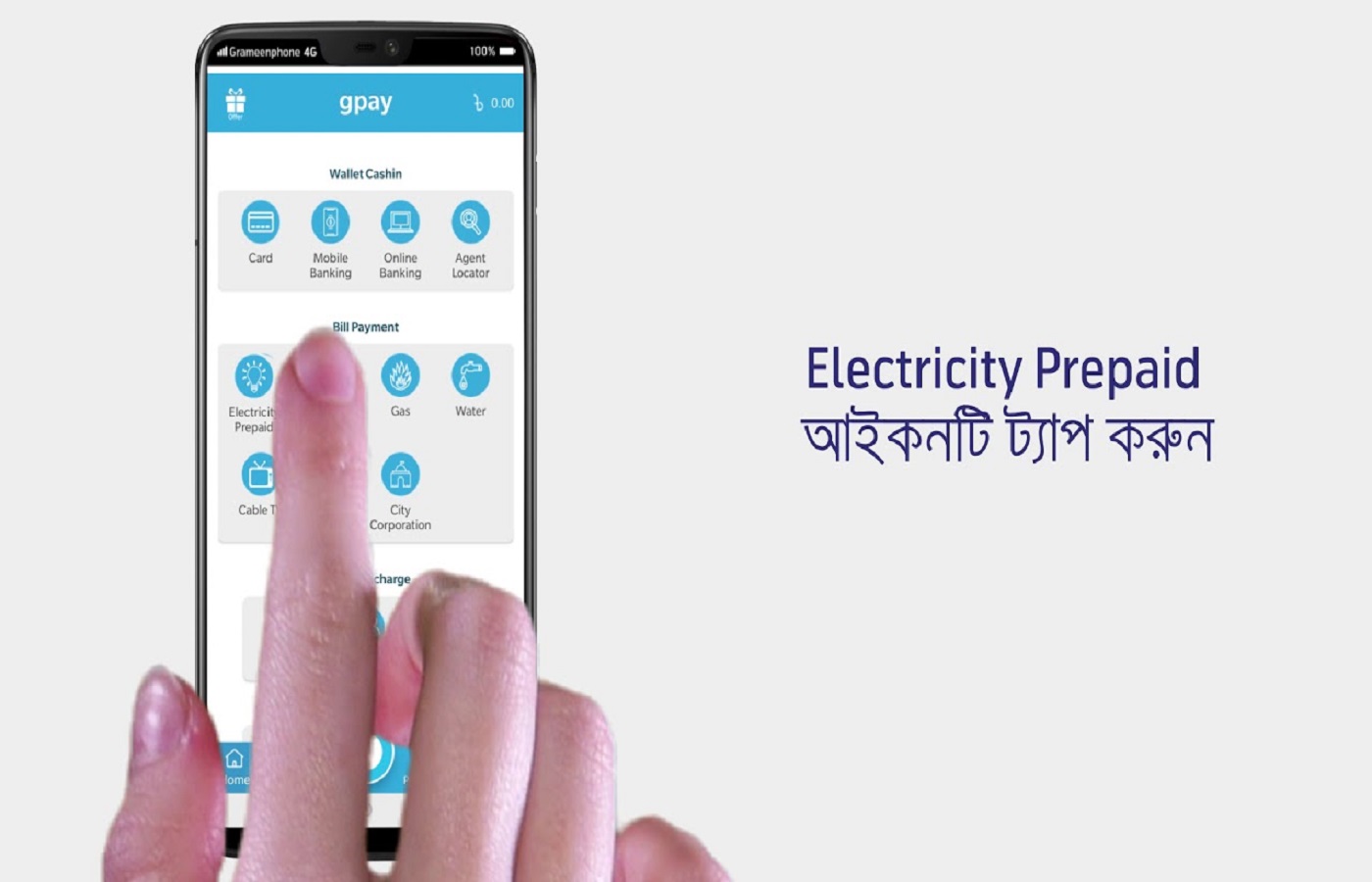

7. Bill Payment Facility

One of the few UPI apps that offer the ability to pay bills is Tez. Even the BHIM App does not support bill payments. You can pay your bills for electricity, DTH, mobile, gas, and other services using this app. More than 100 billers are listed. The Bharat Bill Payment System has been adopted by Tez. Additionally, NPCI promotes this system to make bill payments simple and affordable. The Tez bill-paying feature also notifies you of the total amount owed to your registered billers. Additionally, you are exempt from having to calculate the bill’s total.

8. Cash Mode

Another distinctive feature of Google Pay is Cash Mode. Users can send money to nearby Google Pay users without providing their bank account information or mobile number. In addition, Google Pay is prepared to dominate the pre-approval loan feature by quickly approving users through the app. Additionally, it aims to make payments easier at retail establishments like Big Bazaar and FBB.

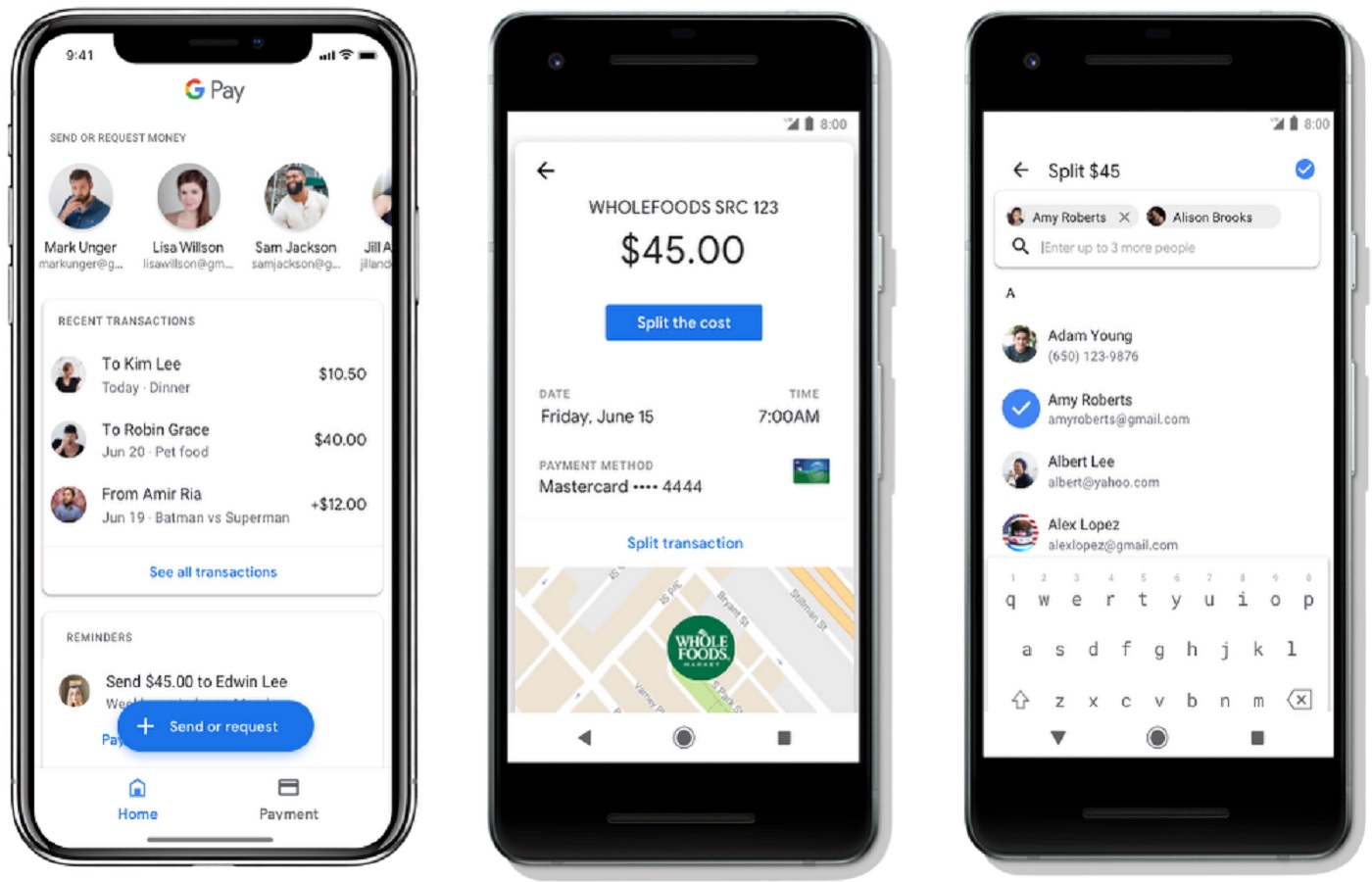

9. Send Money Easily to Contacts

If the recipient and sender both have the Tez app, sending money is even simpler. Utilizing the recipient’s mobile number and email ID is a straightforward way to identify them. As a result, the Tez app verifies a contact’s identity when you choose them by adding their mobile number and email address. It sends money to the recipient based on this identification. You don’t enter any information for fund transfers in this method either.

10. Free Of Cost

The Google Pay (Tez) app is free, just like other UPI apps are. There is no paisa fee associated with the payments. At the same time, you have been paying fees for NEFT and RTGS fund transfers. For providing the UPI system to the Tez and other apps, the NPCI levies no fees. Additionally, Google does not impose any fees for its app.