Due to the increasing use of smartphones by customers, mobile banking apps have reached new heights. Recent years have seen an all-time high in mobile transactions. As neobanks and super apps gain traction as a result of the explosion in digital payments, reports claim that the global growth of finance apps is on the verge of massive expansion. The customer experience has been transformed by mobile apps, and as customer demands change in the coming years, it will be crucial to think about versatile features that will attract high-value customers and keep them coming back for more. When the coronavirus pandemic hit, mobile banking was already on the rise, but the disruptions and limitations brought on by COVID-19 have turned it into a necessity. Of course, the convenience that mobile banking offers is what draws people in. A mobile banking app can assist users in quickly taking care of a variety of financial needs whenever they desire because they carry their smartphones with them almost everywhere.

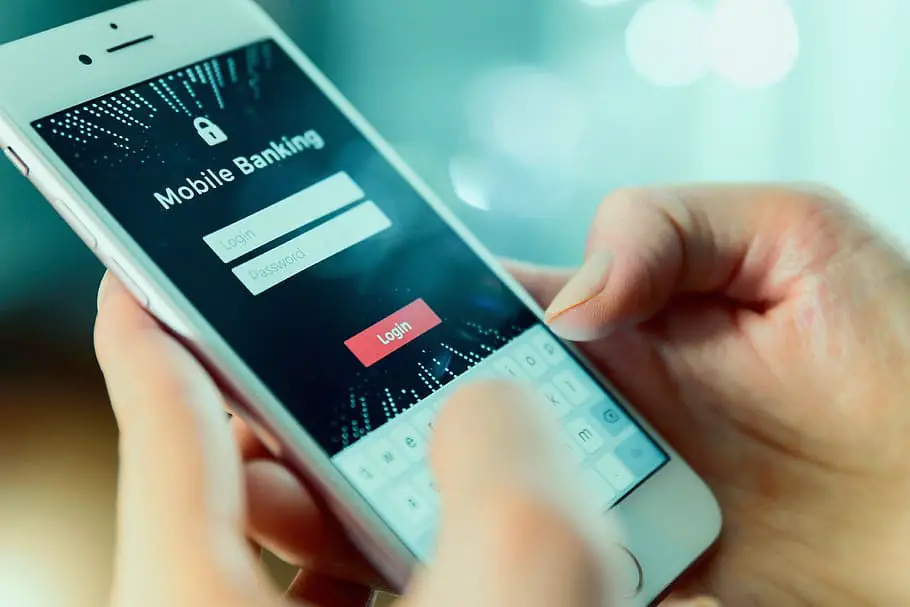

1. When Accessing The Mobile Application, There Is Increased Security

Banking mobile applications are developed with 100% safe and dependable security measures. To protect the user’s passwords and PINs when they use mobile applications to access their online banking account, numerous firewalls and security layers have been assembled. Utilizing applications with advanced security features ensures the reduction of risk factors like data breaches.

2. Intuitive Interface And Ease Of Navigation

The app’s user interface should be straightforward to use, first and foremost. Many apps tend to give users a disjointed experience with inadequate navigational instructions that ultimately force them to give up. With an in-app search feature that enables users to conduct a voice search or type in a query, the app must make it simpler for users to navigate. It should also have smart shortcuts to access frequently used app features.

3. Personalization

Personalization is currently the most important feature of a mobile app. This feature can be useful for engaging and appealing to the young customer segment. Consider in-app virtual assistants that provide individualized insights based on a customer’s cash flow or spending habits. Such features are popular in this day and age and assist you in grabbing the audience’s attention.

4. Boost User Engagement With Mobile App

Smart mobile banking apps with excellent usability and functionality are very effective in increasing user engagement, which undoubtedly promotes the company and helps the banks generate revenue. Consider implementing a successful mobile application strategy to improve your banking services and satisfy customer demands.

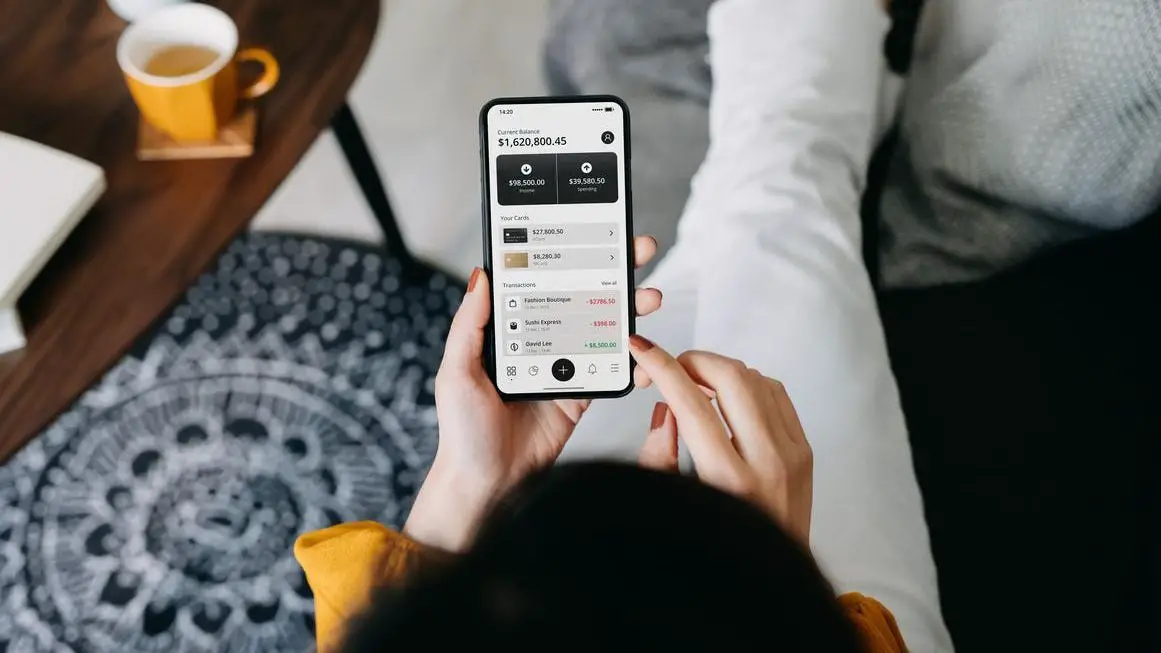

5. Direct And Simplified Banking Services

Any banking service you intend to access through a digital platform can be expected to respond quickly because this platform is quick. For instance, using your mobile banking app makes it simple to check your balance, pay bills in a variety of ways, transfer money between banks, and perform other tasks.

6. Customer Service Options

The top mobile banking apps offer outstanding customer service and support via self-help, live chat, phone, and/or other channels. Customers will find it simpler to contact the institutions in case they have any issues or questions as a result. The apps should make it clear how to get assistance if users get stuck somewhere, regardless of whether they have a chatbot or other methods of contacting customer service representatives.

7. Alerts And Notifications

To stay in touch with customers and promote specific services that meet their needs, notifications and alerts are crucial. However, since customers often find them upsetting, the alerts shouldn’t be too intrusive or bombarding. Users should be able to configure or set up what information they want to receive when they want to receive it, and how frequently. Customers will benefit from the feature and not miss important alerts as a result. The alerts should also have obvious calls to action with options to manage bills, make payments, etc.

8. Secure Sign-in

Given the recent rise in data breaches, cybercrime, and hackers, security is now more important than ever. Customers would undoubtedly want reassurance that their private information was secure. In this regard, multi-factor authentication makes it simpler for a trouble-free sign-in process with secure sign-in options and contemporary features like biometrics, fingerprint readers, facial recognition, codes, and more. Users should be able to experience mobile life safely thanks to the mobile apps’ high level of security.

9. Digital Payments

Another essential component—possibly at the top of the list for most customers—is the option for digital payments. For smooth transactions in this cashless era, every mobile banking app should make it simple to access numerous digital payment options, mobile wallets, UPI, etc. Customers can easily manage their accounts, make bill payments, and set up recurring payments. It would be advantageous to set up recurring payments with an automatic withdrawal from the user’s account because users might forget payment due dates.

10. ATM Locator

The ATM locator is a crucial feature that most customers expect, even though it may seem simple. Additionally, it can demonstrate customer service, and with the aid of virtual reality technology, you can make this feature interesting. Customers may find it helpful to conduct a quick search within the app rather than elsewhere. Statistics show that when a bank added this feature, 90% of users updated their apps to include it, and as a result, there were about 25k additional downloads. A well-designed mobile banking app with the aforementioned fundamental features can go a long way to draw in new clients, outperform the competition, and improve client satisfaction.