According to data from the Certified Financial Planner Board of Standards, Americans with a budget feel more secure, confident, and in control of their money. Sadly, the same study showed that most Americans don’t have a budget, and many of those who claim to do only keep track of their receipts without a system to manage their spending.

1. Qapital Goals Account

You can invest and save money with the help of Qapital, a mobile banking platform. You can use special saving tools known as “Rules” if you open a Qapital Goals Account. You will apply any money you save by applying a Rule to a goal you’ve set up in your Goals Account.

2. Alliant Credit Union

You can set up “supplemental savings accounts” in Alliant’s savings account to save money for particular objectives. By logging into online banking, add goals. Under your current Alliant Account, pick a new account. You’ll be asked to add your savings account when you choose “supplemental savings.”

3. Chase

You can set up three goals with Chase: general savings, custom goals, and a safety net. Having a secure net makes it easier to start an emergency fund. Custom goals enable you to save money for the things you want, like vacations or birthdays. Any savings that aren’t intended for a specific occasion should be kept in general savings.

4. Current Account

A mobile banking platform called Current offers banking services to adults and teenagers. A distinctive function, Savings Pod, is available in the Current Account. The platform’s mobile app allows you to create a Savings Pod to save money for a particular objective. A picture and a description are both options you have.

5. Daylight Account

Daylight is a mobile banking app that supports and serves the LGBTQ+ community. You can set up and check individual financial goals using the mobile app. Daylight also has a guided goal feature, a virtual assistant that can help you learn more about the procedure if you intend to undergo gender-affirming surgery.

6. One

By using a hybrid checking/savings account, one can simplify banking. You’ll be able to manage your objectives individually or through so-called pockets. A Spend Pocket – for your expenses, a Save Pocket, and an Auto-Save Pocket are the first three pockets you’ll have (for automatic savings deposits). Additional pockets for custom goals may be added.

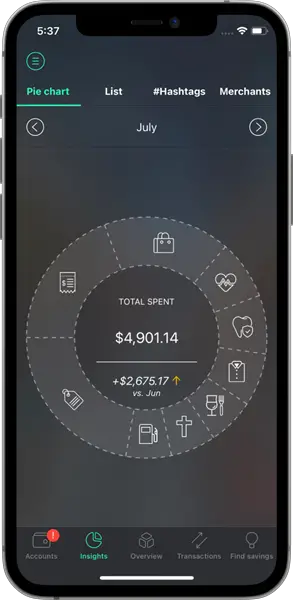

7. You Need A Budget- A Budgeting Tool.

You Need a Budget (YNAB) is the best overall option because it provides the best features and flexibility, making its monthly cost well worth it. It leads you through the process of creating a deliberate, long-term spending plan. Additionally, its reporting and goal-tracking features let you keep tabs on your advancement.

8. Honeydue- A Budgeting Tool For Couples

Because Honeydue is explicitly designed to assist you in managing your money with a partner, we determined that it is the best option for couples. While talking about money issues directly through the app, you can link accounts and control what information you share with your partner.

9. Pocketguard- For College Students

Because PocketGuard makes it simple for busy students to quickly and easily see how much money they have available to spend, we believe it to be the best option for college students.

10. Everydollar- Budgeting Tool For Families

We determined that EveryDollar was the best choice for families because it enables you to create a budget in under 10 minutes that is entirely tailored to your family’s requirements. We determined that EveryDollar was the best option for families because it enables you to create a budget in under 10 minutes that is entirely tailored to your family’s requirements. In contrast to other programs, it makes allocating each dollar easier for families to complete.