Verifying client’s identity is a crucial aspect of conducting the business in accordance with legal requirements. KYC (or Know Your Customer) allows for verification of customer’s ID, in order to ensure compliance with legal requirements. KYC checks are generally conducted when a new user account is created. KYC software helps companies gain a comprehensive understanding of their customers. It can mitigate the risk associated with regulation violations and ensures safety and security.

It helps build trust and establish effective strategies that align with global compliance measures. It encourages financial service providers and businesses to operate with strict policies, to eliminate the adverse effects of financial frauds. This way, it prevents money laundering and creates a secure environment. Using KYC, you will get a digital footprint of the client you are dealing with. The software helps you determine if a person’s ID is real or fake. KYC software utilizes the latest technology of AI and ML to overcome operational constraints and reduce costs. Let us check the Top 10 KYC software and tools businesses can adopt to verify their client’s identity.

1. Onfido

Onfido is the ultimate solution for KYC and AML checks. Its advanced features include PEP screening and transaction monitoring. With Onfido, you get not only live verification and biometric analysis but also the superior benefits of AI technology, which simplifies the application acceptance and rejection process. It helps businesses to connect with their clients in an authentic way. Its “Real Identity Platform” offers comprehensive solution to integrate the data sources, biometric verification, and fraud detection signals.

2. Refinitiv

Refinitiv’s Screening capabilities enhances efficiency and ease the compliance burden. Their “Enhanced Due Diligence” report offers a systematic method to identify and verify the ultimate beneficial owners. It provides necessary resources to meet due diligence responsibilities, such as abiding by KYC laws for anti-money laundering and counter-terrorist financing. It also conducts thorough screening for anti-bribery and corruption. It allows you to access over hundreds of global analysts, utilizing a comprehensive database of 600 sanctioned and law enforcement watchlists.

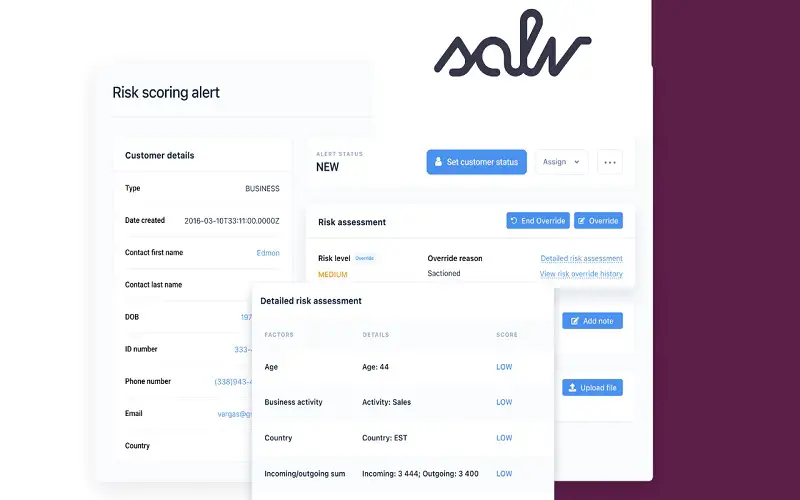

3. Salv

Salv is an innovative organization offering KYC and AML solutions to banking and fintech industries. The company offers practical solutions for fraud detection. With Salv’s advanced technology, you can save time and money by quickly identifying and replacing fraudulent users. Salv platform conducts real-time checks for all the customer transactions. Using their exclusive counterparty monitoring feature, you can gain insights into the details of all the counterparties. Its risk-scoring feature aligns with the latest FinCEN and FCA guidelines.

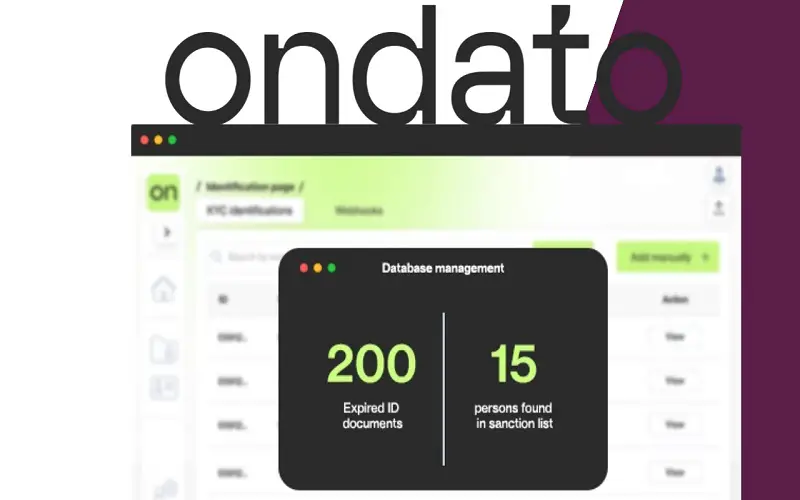

4. Ondato

Ondato is a Lithuanian company that conducts video ID verification and facial biometrics to verify thethe client. Companies like General Financing, Swedbank, and NFT rely on their technology for KYC and AML checks. Ondato’s modular operating system manages the KYC and customer onboarding process efficiently. The company’s dashboard allows for effortless navigation through various modules. The platform covers everything, from verifying and onboarding new customers to authenticating old ones and managing their data. It allows businesses to build a tailored KYC platform by selecting modules that align with their specific business needs.

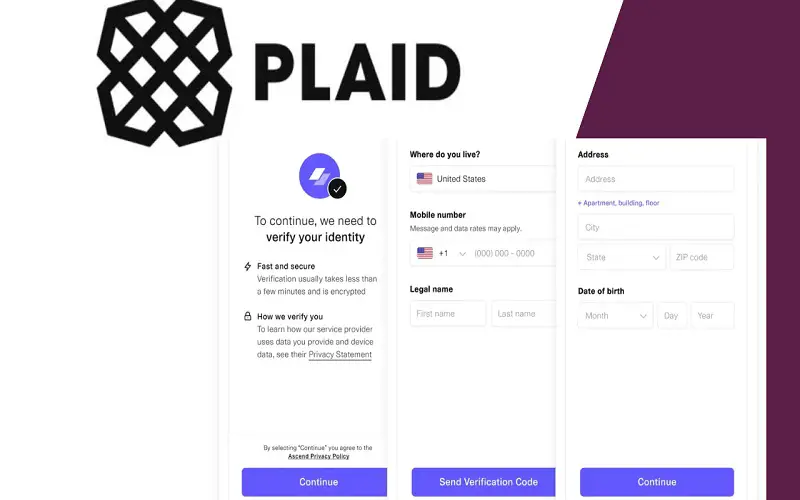

5. Plaid

Plaid effortlessly confirms user’s identity within seconds by cross-verifying it against regulated data sources. It ensures the authenticity of global ID documents. Their Identity Verification system serves as a powerful tool against attacks and frauds. Their anti-fraud engine carefully analyzes numerous risk indicators to ensure utmost security. They also check if the number and address associated with the identity are new, disposable, or linked to external accounts. It offers you greater control to customize risk regulations based on your tolerance level.

6. Seon

Seon helps to identify customer’s true intentions and boost the organization’s fraud prevention efforts. It protects your business by deploying risk rules to access risk levels and guide strategic decision-making accurately. It automatically blocks illegitimate users. It enables diving deep into potential risks by accessing data from over 50 digital and social media platforms. It updates you with the global PEP, sanctions, and crime watchlists through reliable KYC checks monthly. It enhances customer satisfaction with a seamless onboarding process where all the necessary checks are conducted silently in the background.

7. ComplyCube

Utilizing the power of AI technology, ComplyCube verifies customers’s identity in seconds. It combines ID documents, facial recognition, and trusted data sources to conduct KYC verification. Their KYC tools are compatible with all business models, thus providing a hassle-free solution to maximize onboarding rates. By utilizing numerous highly reliable global sources, the platform maintains the accuracy of customer details. With its Ongoing Due Diligence feature, it promptly alerts any change in the customer status.

8. Veriff

Veriff utilizes AI technology and human skills to keep fraudsters away while reducing potential roadblocks for legitimate users. Their comprehensive Database Verification Checks allow easy compliance with the regulations. You can grant access to users of appropriate age while automatically rejecting underage individuals. With a higher fraud prevention rate and faster conversion of valuable customers, Veriff has proven to outperform traditional authentication methods.

9. Togggle

Togggle offers solutions to tackle fraud and build credibility in the finance sector. Its “one-click” process ensures quick onboarding. Using decentralized storage, it minimizes the risk of data breaches associated with centralized verification systems. Togggle updates latest regulations, enabling businesses to focus on growth and innovation, thus leaving the intricacies of KYC compliance to its reliable services.

10. iComply

iComply offers tools for document verification, identity proofing, and biometric authentication for identity verification. There’s also a KYB tool to take compliance to the next level. They also offer safety measures for money laundering. You can easily enable or disable features such as watchlists, PEP, and adverse media checks to meet regulatory requirements. With their intuitive Prefacto and iComplyKYC tools, you can save time and stay ahead in the realm of digital compliance. The platform boasts a wide range of automated checks, including KYC, KYB, and AML screenings, elevating your compliance process to new levels of security and efficiency.