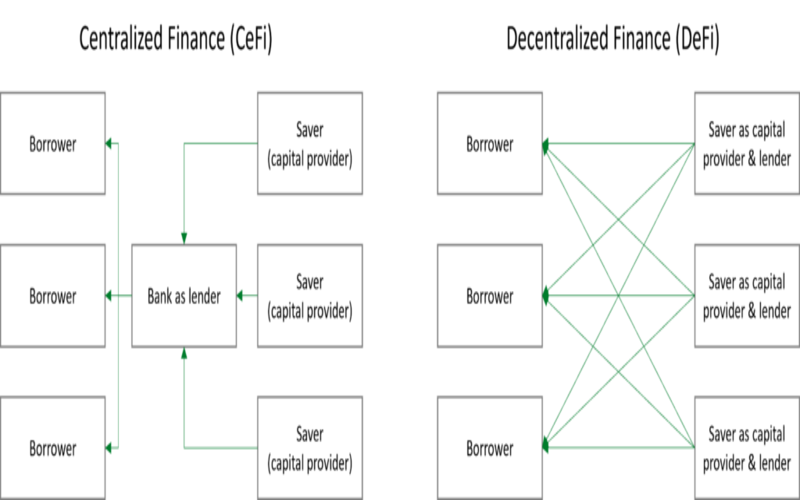

What Is Decentralized Finance – DeFi?

Decentralized finance is an economic system that is manufactured on public blockchains. The parts of open finance are composed of protocols, digital assets, dApps (decentralized applications), and smart contracts, which are established on the blockchain. The introduction of decentralized finance has unclosed a world of new possibilities for consumers to collaborate with the Ethereum blockchain in ways that were not available before. By using DeFi, consumers can give or purchase Ethereum-based assets, receive interest on their crypto-catching trade digital assets without using employ, a personalized exchange, and much more.

The purpose of initiating decentralized finance is to provide consumers with an alternative to traditional financial institutions, which are frequently inaccessible.

How Does DeFi Work?

Decentralized finance offers a way to approach financial services without requiring a centralized mediator. It uses smart contracts to allow association interactions on the Ethereum blockchain. Two main parts enable an economic system to work efficiently the first is the structure required to serve and the second is the rupees that are necessary to perform with.

Structure – Ethereum is a DeFi field used for writing decentralized programs. Through Ethereum, you can generate intelligent contracts that can be pre-owned to manufacture a set of situations or rules under which an accordance can be made. Once a smart contract has been employed, it cannot be changed.

Features

- One of the essential DeFi features that clearly defines the differences between DeFi and standard banking apps is that the late comes with the power of code clarity. It makes it available for anyone to audit, which builds trust with consumers because everyone can get to gain insights into the contract’s functionality. Since the agreements are pseudonymous, the privacy questions never emerge. Furthermore, in standard finance, the financial operations are organized by a mediator, so protection breaches may arise.

- Decentralized finance, or DeFi, uses merging innovation to eliminate third parties and centralized groups from financial agreements.

- The parts of DeFi are cryptocurrencies, blockchain innovation, and software that enable people to interact financially with each other.

- DeFi is still in its minority, subject to hacks and thefts because of sloppy developers and a lack of protection testing before applications are initiated.

Features Of Decentralized Finance

It is also possible to gain a good understanding of the aspects of DeFi by reflecting on its benefits. The benefits showcase the value theory provided by DeFi or the characteristics in which you can involve DeFi solutions. Here are some of the outstanding characteristics you could find with DeFi.

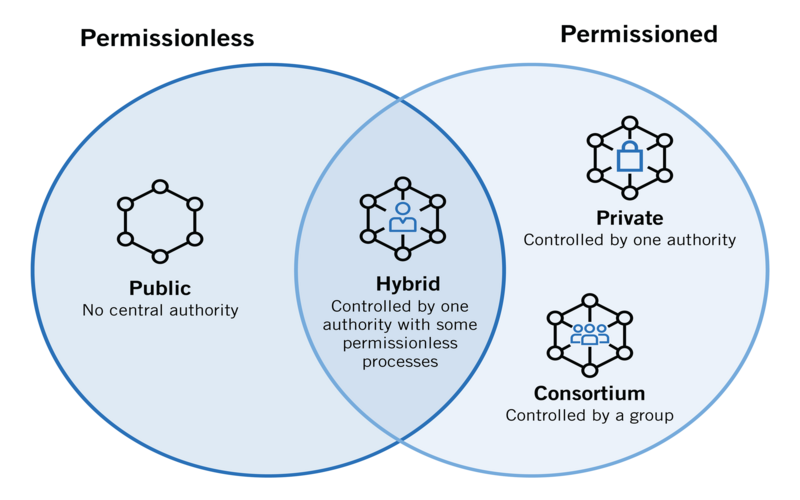

1. Permissionless

One of the principal features of DeFi that catch awareness is the permissionless nature of DeFi applications. DeFi does not obey the conventional rules of access chased in standard finance. It regards the open, permissionless access model. Any independent could access DeFi solutions through an internet association and a crypto wallet. With these two significantly, you could purchase DeFi regardless of geography or number of incomes. As an outcome, DeFi could welcome almost any independent to the financial system.

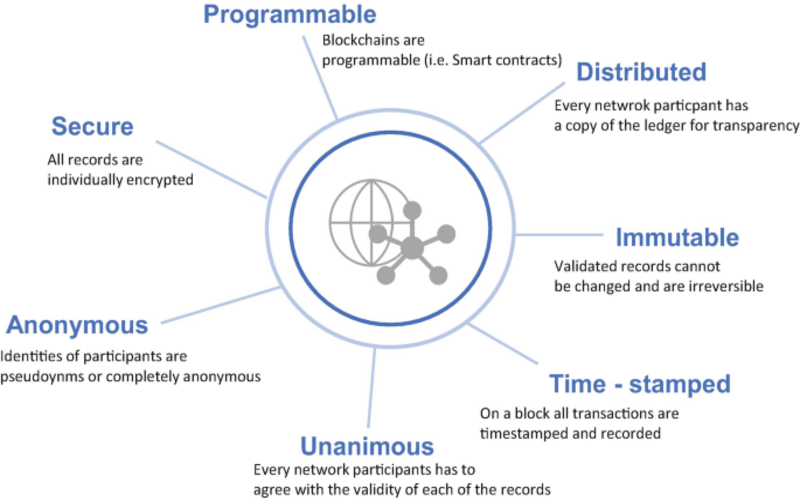

2. Programmability

Another outstanding entry among characteristics of decentralized finance is programmability. It is necessary to note that most DeFi solutions accessible now are based on the Ethereum blockchain. Therefore, the chances for available smart contracts with higher opportunities of programmability in DeFi could assist in automatic implementation. At the same time, the programmability in DeFi also opens up the latest path for making the latest financial instruments and digital assets. As a result, DeFi has all the necessary resources to manage any traditional financial service function.

3. Transparency

One of the most prominent and evident DeFi characteristics would pay awareness to transparency. Every agreement must be transmitted to other consumers on the network, in the case of the popular Ethereum blockchain. All the consumers should confirm the transaction telecast to them. It is essential to note that all the Ethereum addresses that are generally encrypted are crucially attended with pseudo-anonymity.

4. Interoperability

The features of DeFi also discuss interoperability as one of the choices necessary in the financial services ecosystem today. Ethereum’s prepared software stack helps to ensure that DeFi conventions and applications are ready for implementation and decoration. DeFi provides adequate reliability to programmers and product teams. Now, programmers could simply generate new solutions or add benefits to existing agreements. Simultaneously, programmers and things teams might acquire DeFi options to customize connections and implement third-party applications.

5. Custodial

The fourth and most crucial aspect of DeFi is that customers have complete control over their benefits and personal information. The use of web3 wallets such as MetaMask assists consumers in efficiently interaction with permissionless information. DeFi solutions can encourage the latest age of financial services outfit for the user. The specific DeFi characteristics are quite a critical entrance in almost all conversations relevant to the origins and development of decentralized finance. The distinct characteristics of DeFi rules make them conditions for several DeFi use cases.

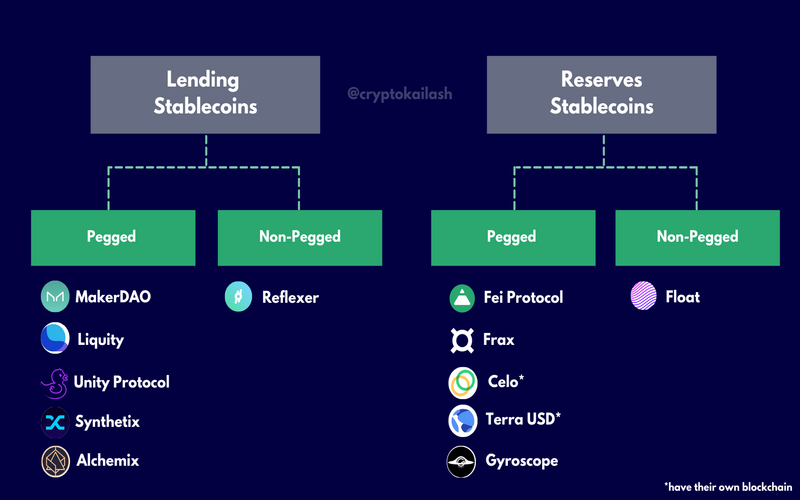

6. Stablecoins

Fiat-pegged cryptos like USDT and DAI offered consumers dollar discloser and stable costs.

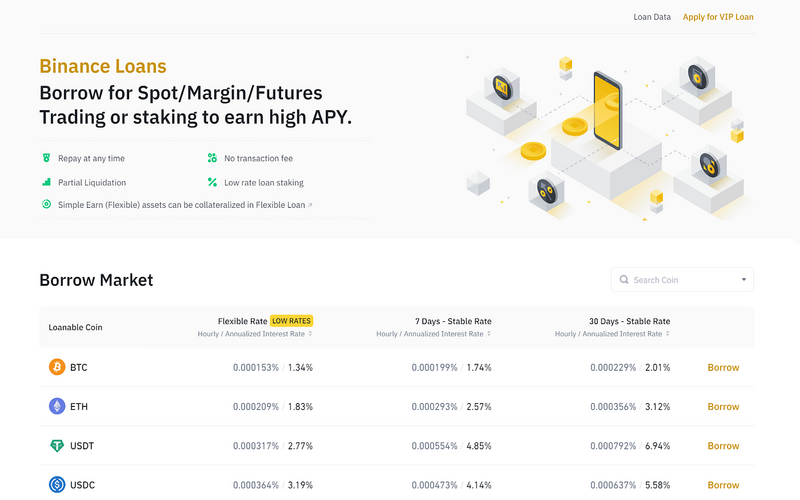

7. Crypto Lending and purchasing

Decentralized applications like Aave and Maker DAO establish crypto markets.

8. Decentralized exchanges (DEX)

Smart contract innovation enabled consumers to trade DEXs.

9. Yield farming

The requirement for fluidity in the DEX lending industries resulted in fluidity pool markets where consumers could spread their cryptos and earn interest on them.

10. Decentralization

DeFi’s hallmark characteristic is decentralization. Standard finance depends heavily on centralized access, it is exposed to censorship, deceit, and inefficiencies. DeFi, being decentralized, reduces the need for trust in a single entity while operating transparently and securely.