The payroll system determines the salary of each employee. Using payroll management software, employers can track salaries, bonuses, bonuses, gross and net wages, tax deductions, and insurance payouts for their employees. Every employer should keep a detailed record of all employee financial records, whether they use hard copies or cutting-edge technology. Payroll software helps reduce the cost of hiring an accountant and calculating salaries. Therefore, the ten must-have features for payroll software are.

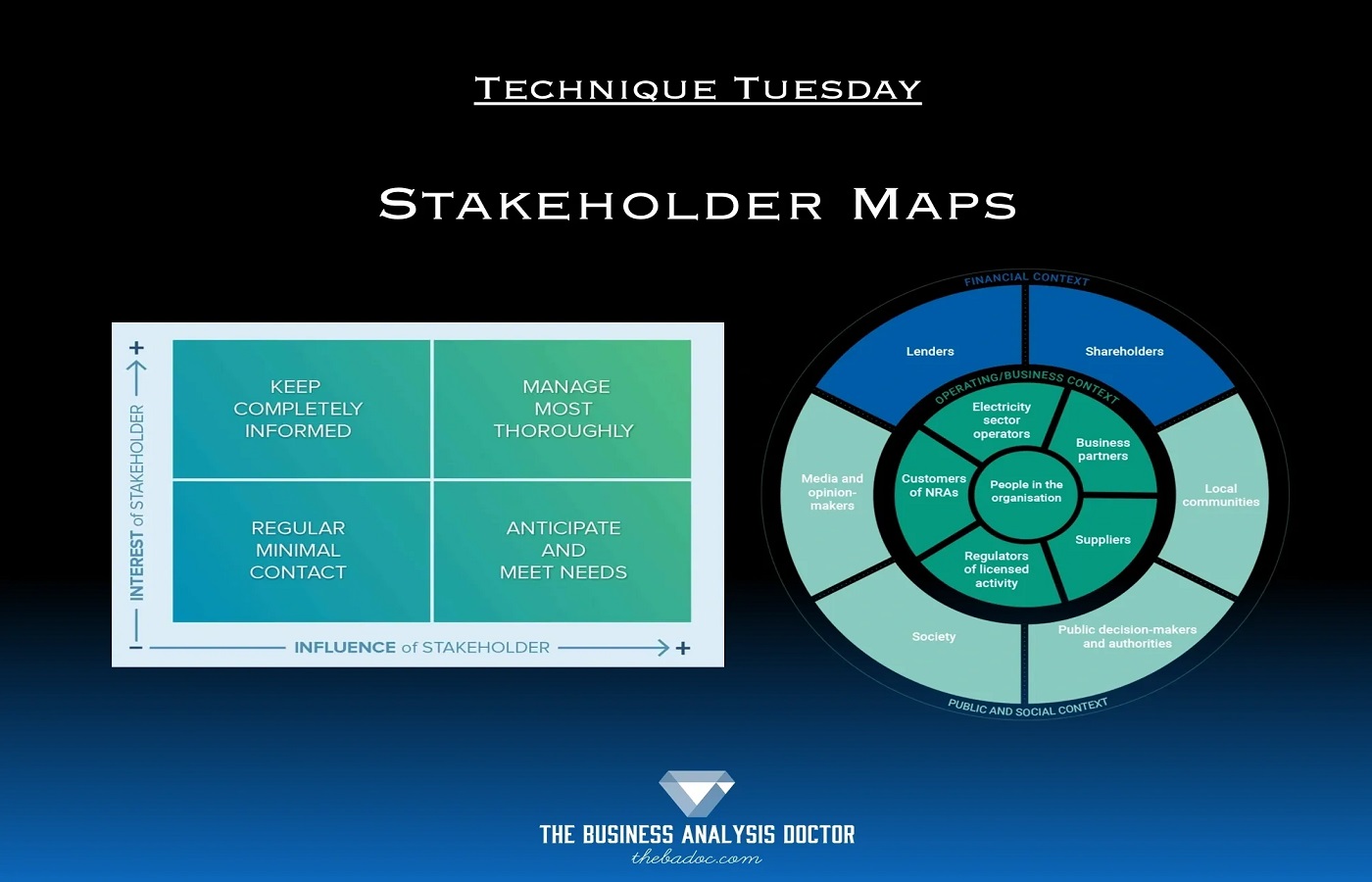

1. Data For All Your Stakeholders

Pay slips for your workers, Management Information System Reports for Executives, Salary Transfer Statements for Banks, and Salary Variance Reports for Auditors Software should generate data for all your stakeholders, including income tax statements for the tax department and statutory reports for the government.

2. Customization

A payroll management system should be simple to customize to your company’s needs. Payroll functions should also be simple to personalize for different levels of employees. Payroll systems must consider a large amount of data. Even if they are on the same level, compensation for each employee is likely to differ. A reliable payroll management system should customize every function, even if the difference is minor.

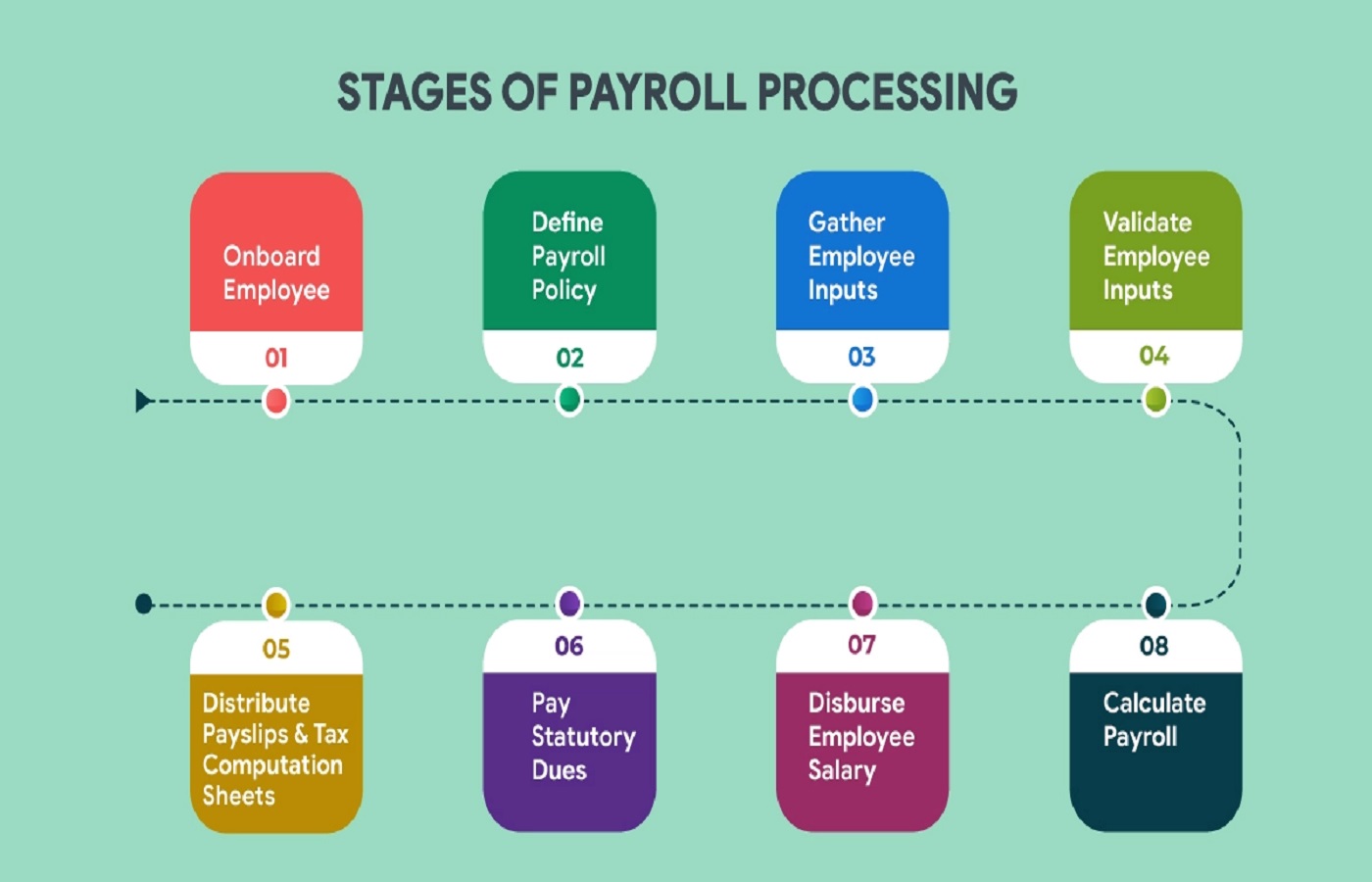

3. Payroll Processing And Management

The function of any payroll system is obviously to process and manage payroll. Providing employees with their preferred payment method is essential for a good employer. This foundation serves as the foundation for all other payroll software features.

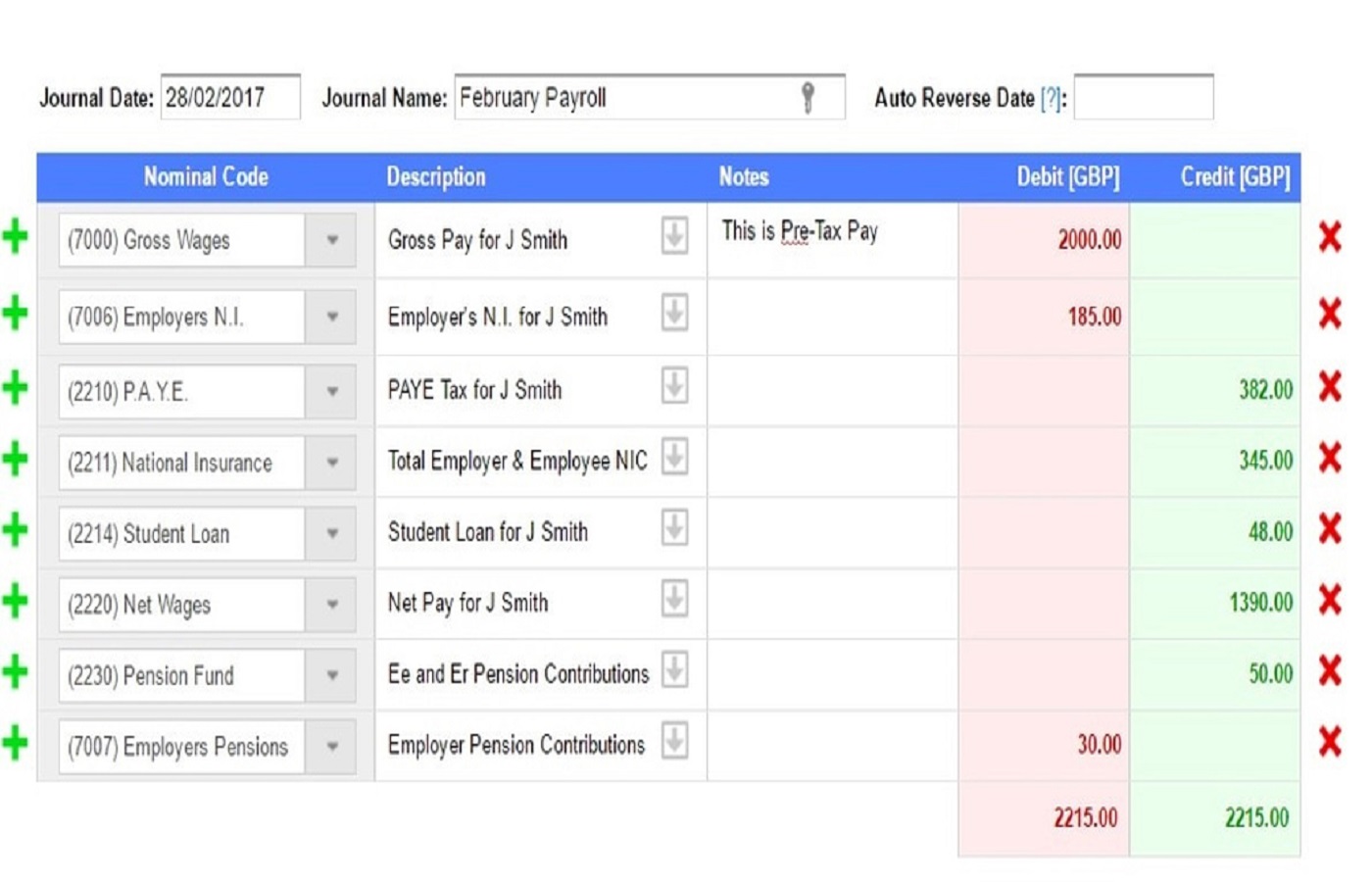

4. Recording Files And Pay Slips

Reports generated by the software include a leave summary, salary benefits, and salary statements. The software can print pay slips using the digital platform. This software, which serves as the sole repository of employment records and documents, can be used for any business. This software includes essential features such as an experience letter, an organizational chart, an employee profile, occupational safety and tax information, and an offer letter.

5. Statutory Compliance

No matter where you live, payroll software should assist you in complying with all legal and statutory requirements in all countries where your company has a presence. You should be able to submit reports and statements to the government using the software. Payroll software should support employee benefits such as Provident Funds, Employee State Insurance, Professional Taxes, Wage Protection System, and others.

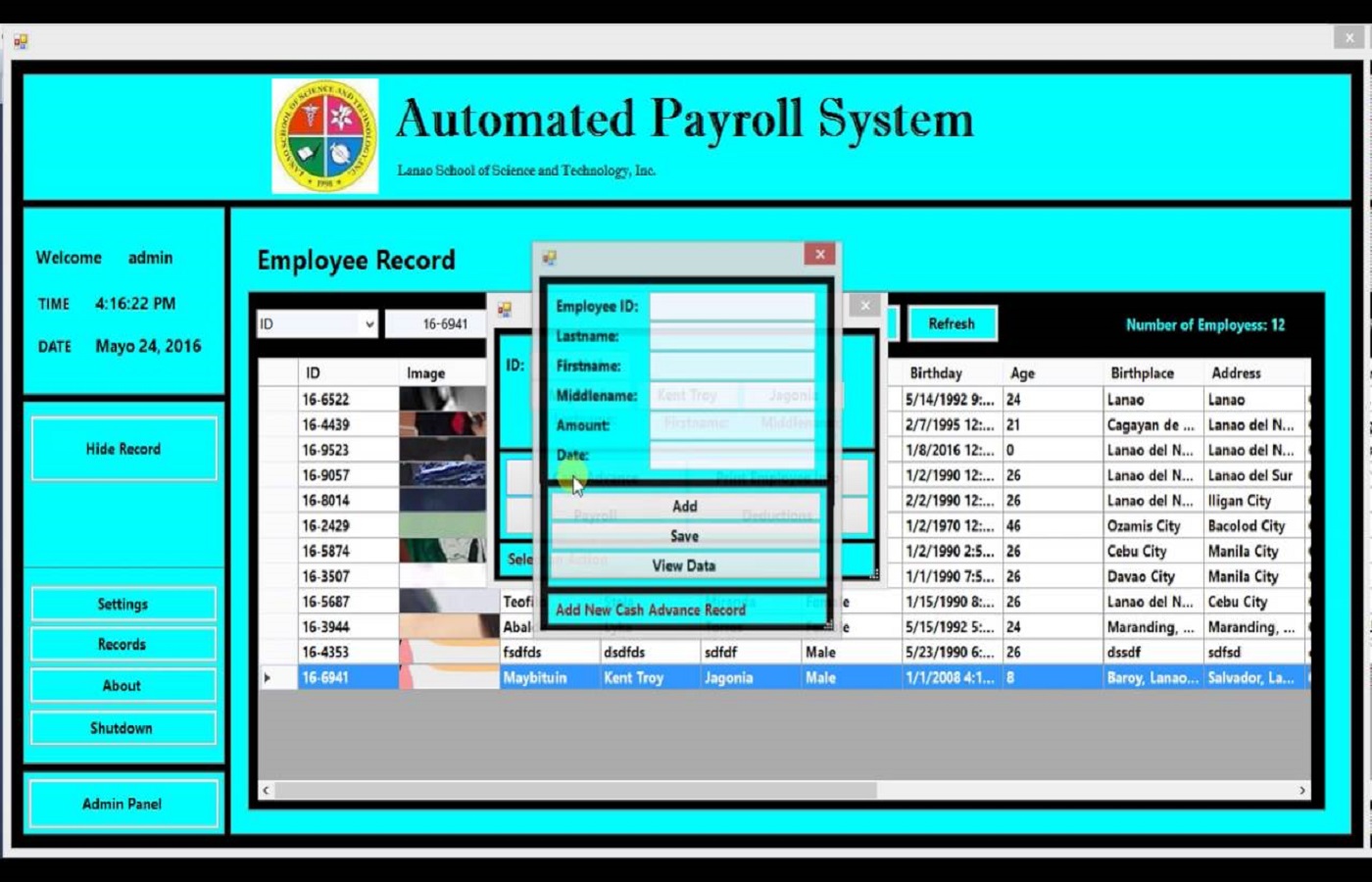

6. Automated System

If they continue to burden your HR resources, investing in a payroll management system is pointless. Good payroll software frees your HR department to make better decisions and policies. An automated payroll management system simplifies and improves HR department’s work.

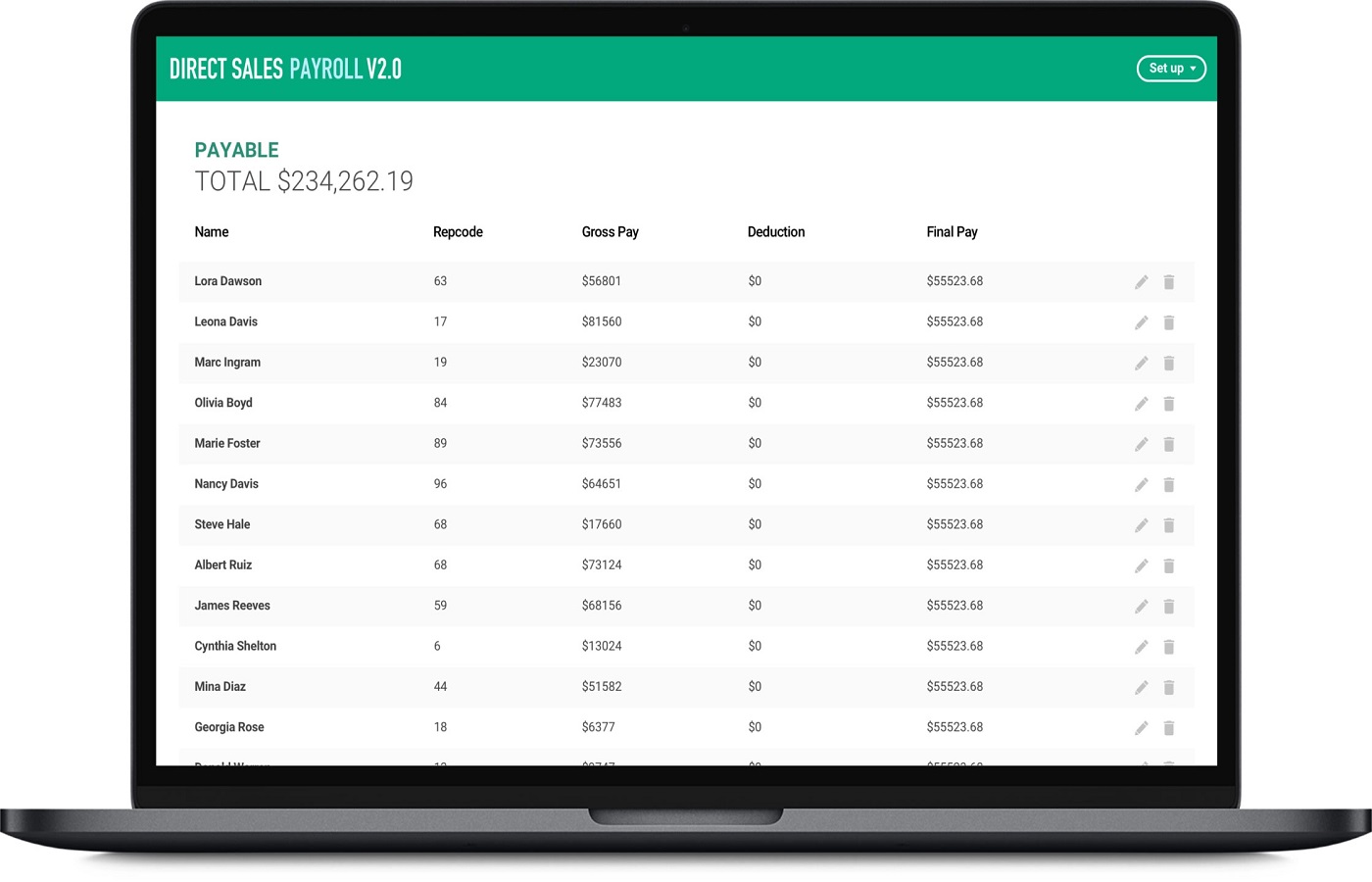

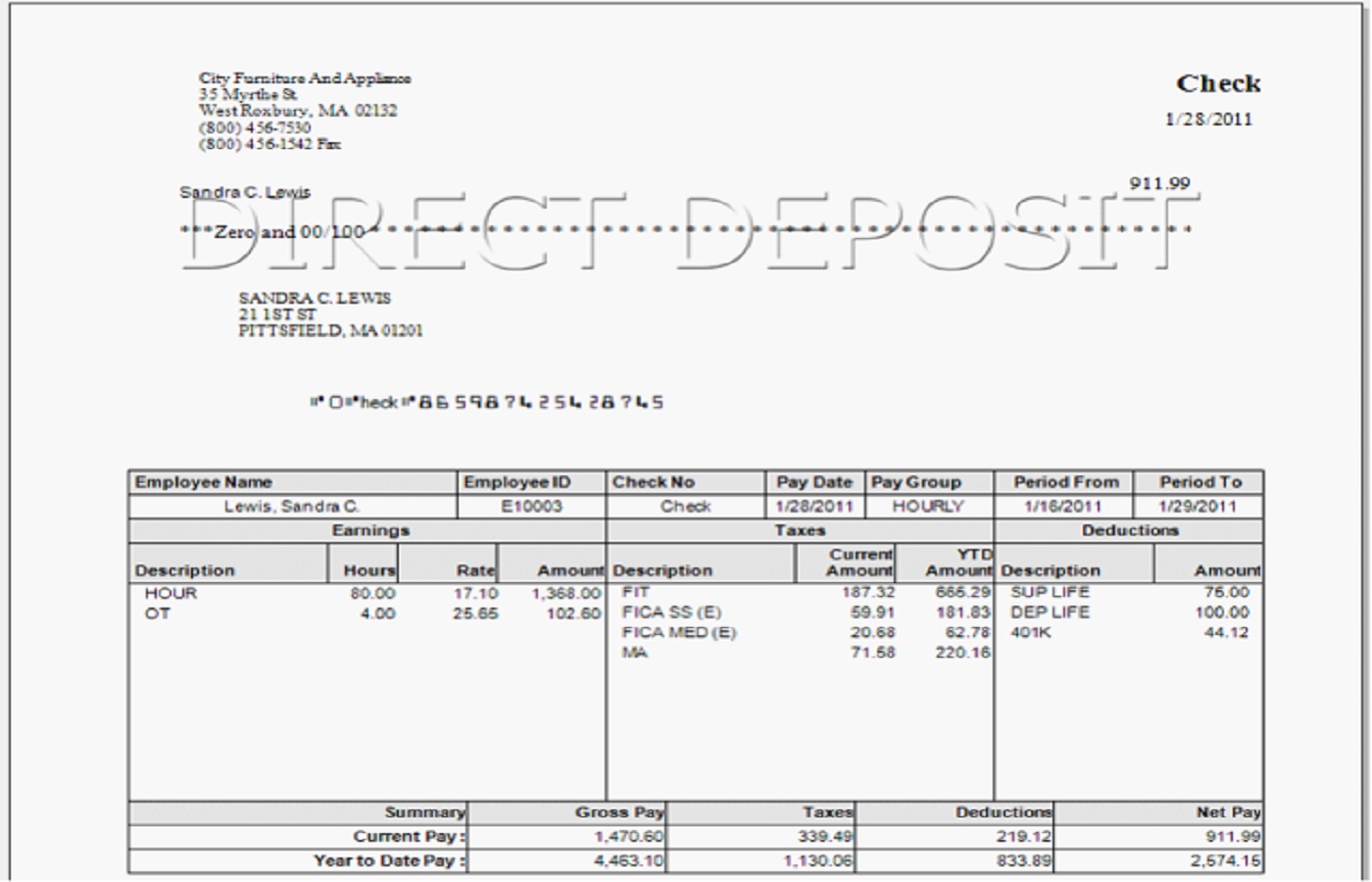

7. Direct Deposit

One of the payroll features is direct deposit. After all, the purpose of a payroll system is to ensure that your employees are well-paid. The days of distributing checks at the end of the week are long gone. Direct deposit benefits both businesses and employees. By avoiding printing and distribution of paychecks, companies save money and time. At the same time, employees are not at risk of losing their checks or falling victim to check fraud.

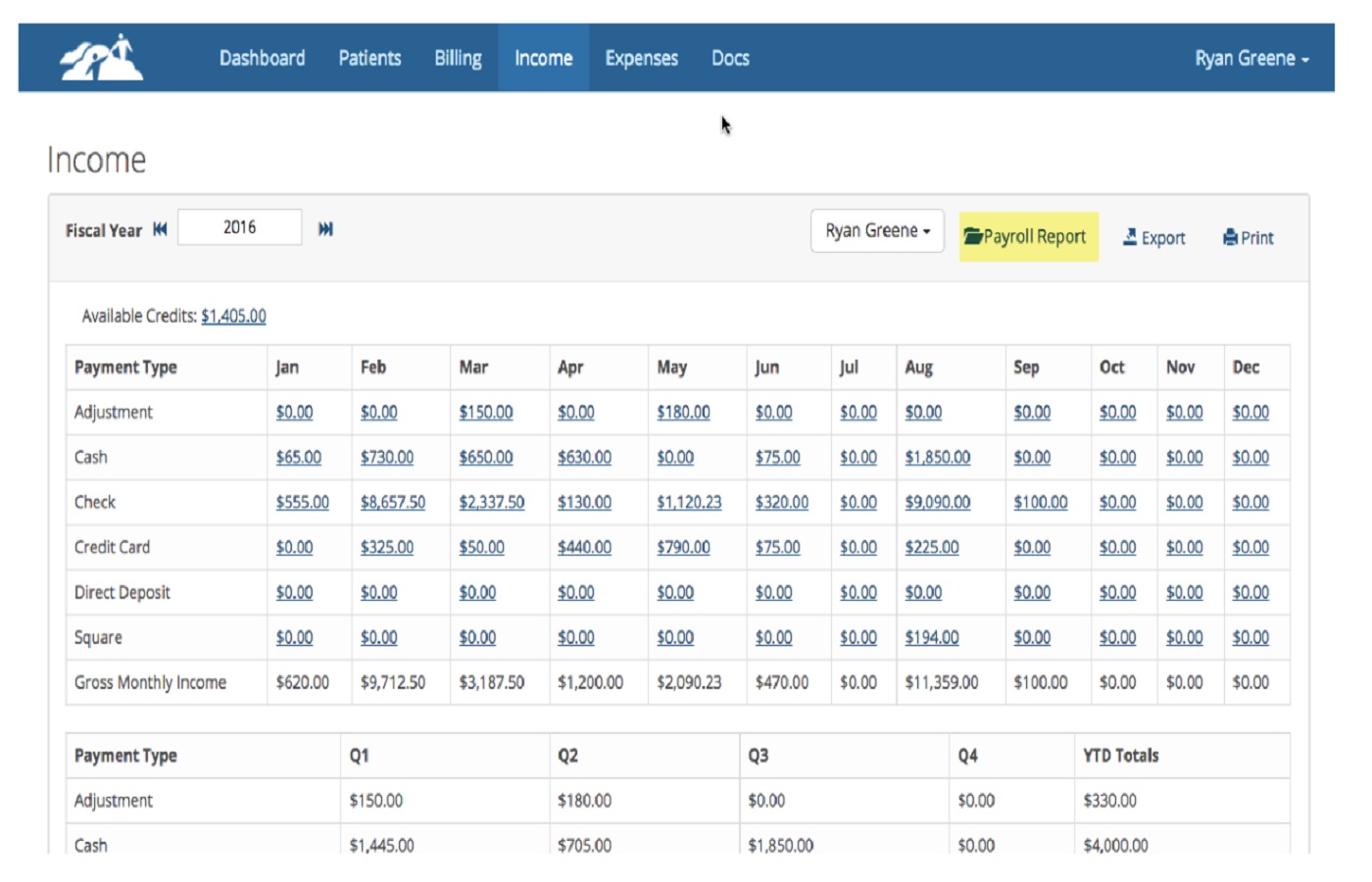

8. Reporting

As different teams use the reports, the software may limit resource allocation. The features of payroll software optimize the reporting process. Before purchasing any software, make sure it has the essential reporting features.

9. Employee Self-Service

Employee Self Service enables the publication of pay slips online, allowing employees to access payroll information from any location. Employee Self Service also enables employees to select income tax structures and file income tax returns.

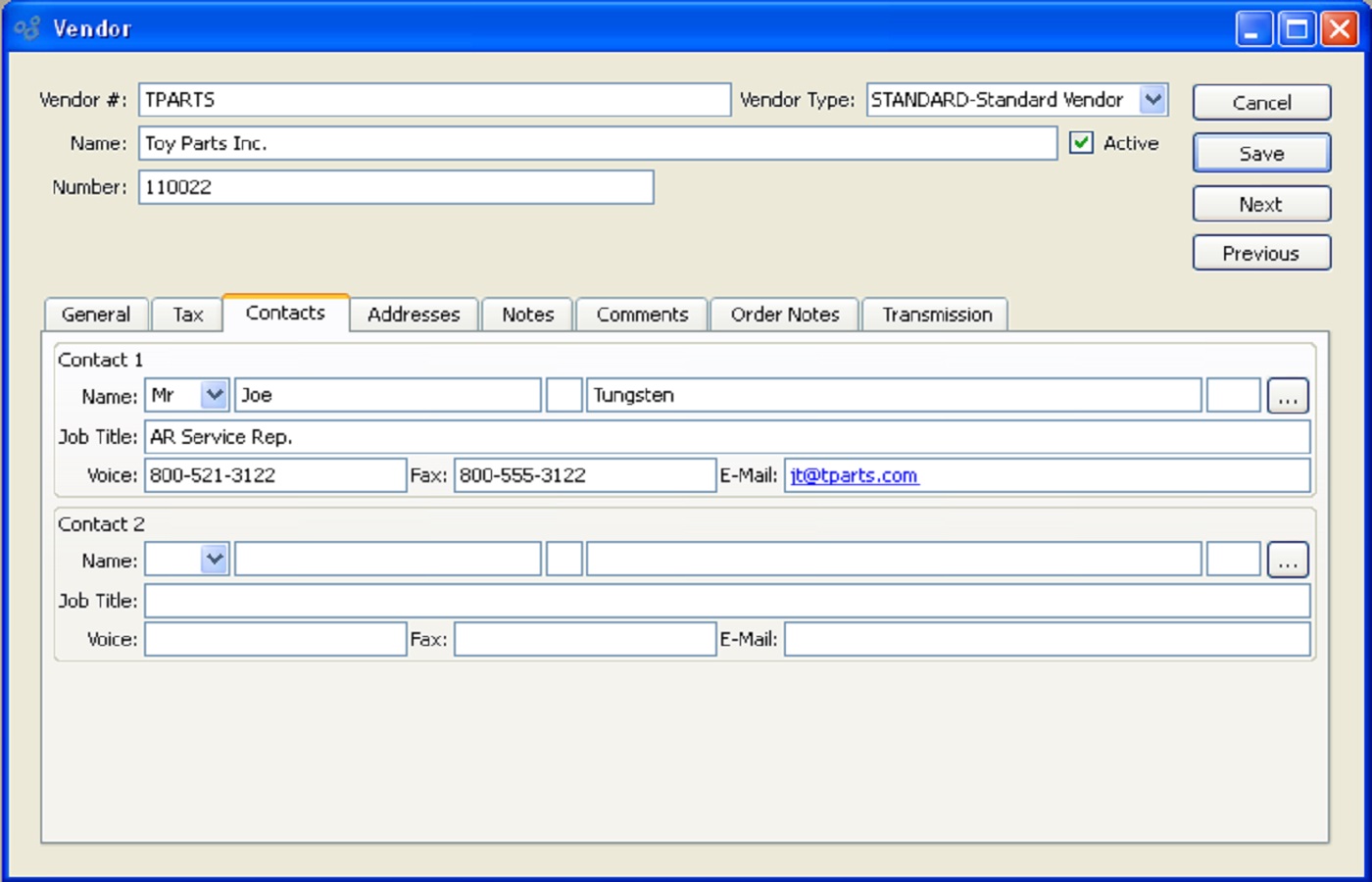

10. Vendor contact tools

Most businesses must communicate with their vendors regularly. The majority of vendors and contracts require monthly payments. Having payroll management systems that connect you to your vendors simplifies your life.