Cryptocurrencies have exploded in popularity over the last few years. With over 10,000 different cryptocurrencies in circulation, traders have their pick of assets to buy and sell. However, effectively analyzing and making profitable cryptocurrency trades requires using the right tools. I think the top desktop software and platforms for crypto trading and analysis are TradingView, CoinMarketCal, CoinMarketCap, CoinGecko, Glassnode, Coin Metrics, LunarCrush, Skew, 3Commas, and Koinly. Staying up-to-date on crypto news and events is easier with CoinMarketCal. Tools like 3Commas allow the automating of advanced crypto trading strategies. And Koinly gives investors an easy way to track taxes. Whether you’re an amateur or professional trader, this collection of desktop software and platforms will give you a leg up in the dynamic crypto market. These provide vital on-chain data, analytics, alerts, automation, and portfolio tracking.

1. TradingView

TradingView is a charting and social networking platform designed for financial markets. It allows traders to develop and backtest trading ideas and customize charts with 100+ technical indicators. TradingView has a huge online community where you can connect with other traders and copy successful strategies. Crypto, offers order book data, active trader indicators like volume at price, and embedded trading through exchanges like Coinbase. The free plan is enough for most, but power users can upgrade for more real-time data. Overall, TradingView is the best software out there for charting and analyzing crypto price action.

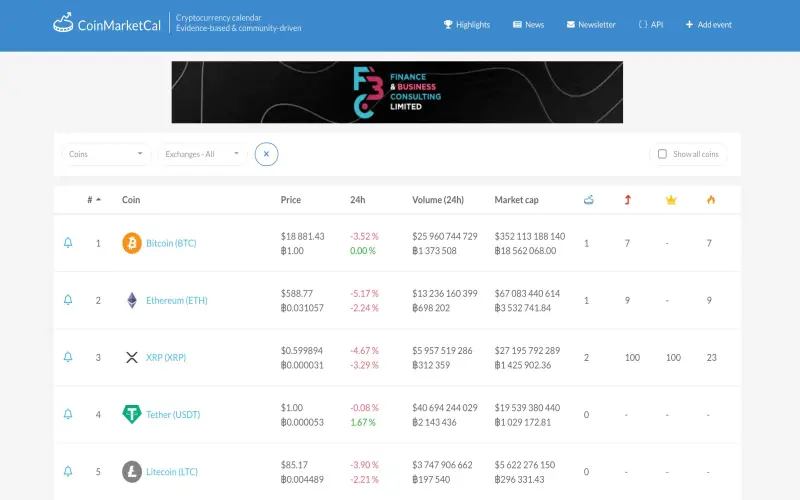

2. CoinMarketCal

Keeping up with cryptocurrency news and events is crucial for timing your trades right. CoinMarketCal is the leading calendar platform tracking launches, meetups, product releases, and other crypto events. It catalogs thousands of upcoming events so you never miss something that could impact your portfolio. You can also filter events by cryptocurrency, category, coun, try, and more. Additionally, CoinMarketCal has an automated alert system to notify you when relevant events are approaching. Rather than scrambling around Twitter and Reddit, CoinMarketCly makes it easier to stay informed on the crypto calendar.

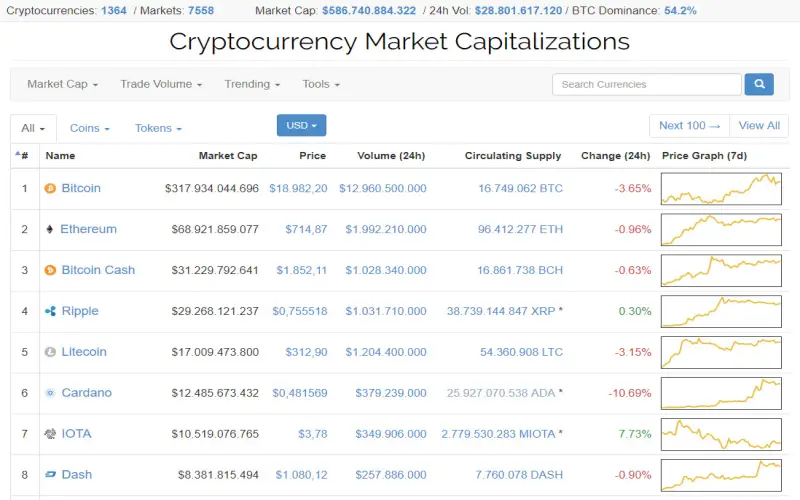

3. CoinMarketCap

When getting started in crypto, CoinMarketCap is one of the first sites you’ll come across. It’s the most visited price tracking website for good reason. CoinMarketCap lists key data on over 13,000 coins including price, market cap, volume, sup, ply, and trading pairs. You can view cryptocurrency prices in your preferred fiat currency and set price alerts. Additionally, CoinMarketCap has indexes of crypto exchanges, stablecoins, DeFi platforms, NFT marketplace, prices and more. This makes CoinMarketCke a one-stop shop for discovering and researching digital assets. While the free version covers most needs, CoinMarketCap Alexandria provides even more data and tools for premium subscribers.

4. CoinGecko

Similar to CoinMarketCap, CoinGecko is a market data aggregator tracking over 10,000 cryptocurrencies across 500 exchanges. In addition to prices, volume, and market capitalization, CoinGecko calculates crypto developer and community metrics. These include code repository tracking, social media domina, NCE, and developer score. Geckometer is another unique feature showing the “hype-to-activity” ratio for crypto projects. This helps determine sustainably popular cryptos versus short-term fads. Furthermore, CoinGecko has a comprehensive section on DeFi tracking criteria like total value locked. For these reasons, CoinGecko gives a more well-rounded look at cryptocurrencies beyond just price data.

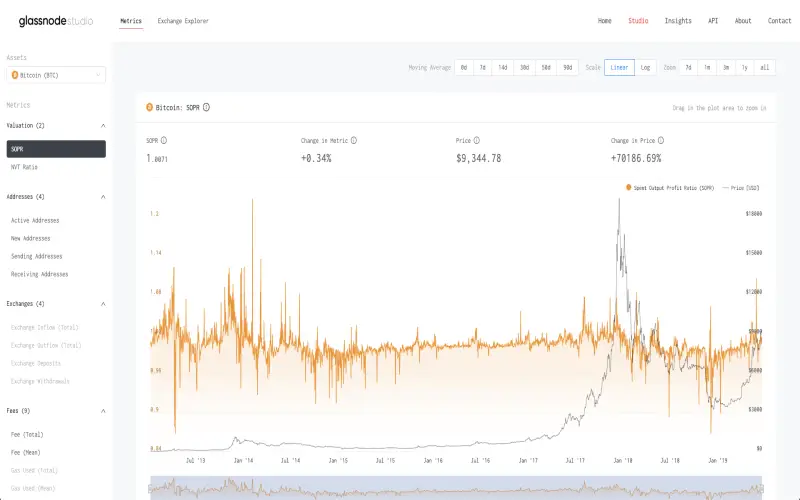

5. Glassnode

Glassnode is an on-chain analytics platform that lets users dive into blockchain data. It tracks activity across Bitcoin, Ethereum, and over 1,300 other cryptocurrencies. Glassnode offers metrics on topics such as investor behavior, mining, transactions, fees, supply distribution, liquidations, and more. The platform enables the identification of trends and patterns through custom charts, ratios, and statistical modeling. Although Glassnode has a free tier, unlocking Studio features like automated alerts, derived metrics, and Excel integration require a paid subscription. For hardcore crypto analysts, Glassnode provides an immense level of transparent, real-time blockchain intelligence.

6. Coin Metrics

Where Glassnode focuses more on traders and investors, Coin Metrics caters to institutions and businesses with transparent network data. It captures comprehensive blockchain statistics on exchanges, wallets, fees, transactions, mining, and other activity. Coin Metrics supplies transparent reference rates like Bletchley crypto indexes. It also delivers data-driven market insights, network risk monitoring, and more for crypto businesses. While you need to request pricing for full access, Coin Metrics has free daily reports and resources that are helpful for analysis.

7. LunarCrush

Understanding cryptocurrency social insights can provide an advantage for timing your trades. LunarCrush tracks social media analytics and market data across thousands of cryptocurrencies. It offers tools to identify rising and falling assets based on social engagement. You can view metrics like social volume, sentiment, mention influence, and more. LunarCrush also enables the discovery of trending news and influencers in the crypto social sphere. It even shows how much a coin’s price and social volume correlate over time. While LunarCrush has a free plan, unlocking more features requires a paid subscription. Overall, harnessing social analytics alongside price and on-chain data can boost trading intelligence.

8. Skew

For crypto derivatives traders, Skew is essential for aggregating derivatives data across exchanges. It focuses on Bitcoin and Ethereum options, futures, and perpetual swaps. Skew provides historical charts plus real-time dashboards tracking derivative prices, volumes, open interest, and more. You can also view implied volatility analytics to see market expectations of future price movements. In addition, Skew gives insights into activity by different derivatives traders like institutions.

9. 3Commas

Crypto trading bots have become very popular for automating trades. 3Commas is a multi-exchange bot platform that works with 20+ exchanges. It allows you to set up trading bots using technical indicators, copy successful bot strategies, and more. 3Commas offers bots for the grid, DCA (dollar cost averaging), smart-trade, and other strategies. The platform also includes useful portfolio, trading, and risk management tools. Overall, crypto bots can be great for executing automated trades 24/7 based on preset conditions.

10. Koinly

Keeping up with crypto taxes and accounting can be a major headache. Koinly helps crypto investors handle capital gains taxes, get audited, and value portfolios. It connects with wallets and exchanges to automatically track and calculate taxes on your trades. Koinly supports over 300 exchanges and 20 blockchains including major ones like Binance, Coinbase, and Metamask. The platform can generate needed tax reports including capital gains, income, and gifts reports. Although Koinly has a free plan, unlocking integration with TurboTax and other features requires a paid package.