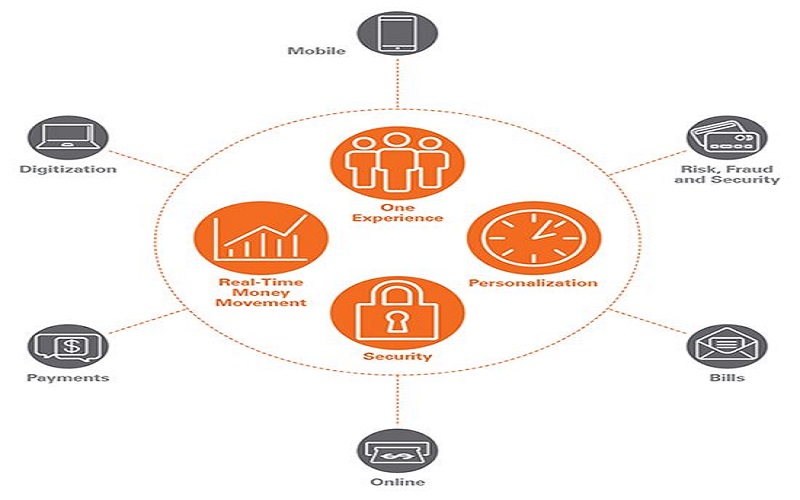

The financial sector is undergoing a substantial shift in the digital transition. Bank is expanding its offering and meeting client expectations because of technological advancements. Customers seek simplicity, accessibility, flexibility, timeliness, and low banking charges. The epidemic resulted in a significant rise in new Internet banking registration. The shift in payment patterns is critical for the banking sector digitization.

1. Digital Channels

Customers want banks to get digitized in the same way businesses and services are. Financial institutions recognize a sizable percentage of the client base for a rival that provides the ease of digital channels. It is true even if the competitor’s heritage, reputation, and list of services is deficient in other areas. The current trend of Internet banking doesn’t need physical banks in the future.

2. Customer Experience And Expectations

Modern analytics enable businesses to comprehend customers interactions with them. It allows to shape and provide personalized consumer experience. Banks successfully customize their clients experience and prioritize personalized service to see customer satisfaction and retention. It demonstrates the transition in digital for front-end adornment and modernity. Analytics and back-end digital technology are crucial.

3. Chatbots And Virtual Assistants

It utilized, and its quality and accuracy are increasing as artificial intelligence technology becomes robust and powerful. Customer service is becoming faster as technology progresses. Chatbots and virtual assistants help clients with simple commands. It is unusual to fix issues without consumers dealing with a live person if banks create and prioritize current developments in AI technology.

4. Big Data

Digital transformation is not easy task. It necessitates a comprehensive understanding of consumer’s behavior and interaction with the service. Data is a valuable asset. Data and analytics are customer encyclopaedia. It applies to various businesses, but banks benefit the most. The number and quality of data banks collect through their clients determine the success of the digital transformation.

5. Banking Apps

Smartphone apps altered the way we live. Banking application is on the way for the most critical tool in the pocket. Banking applications became personal assistants by detecting patterns in recurrent transactions like rent and monthly payments. It provides enhanced accuracy in payment reminders, money routing, and autopay choices.

6. Balancing Digital Convenience And Personalized Service

Banks eliminate physical offices. It is critical to strike a balance between the ease of digital banking and the personalized care that clients want. Internet banking is grown in popularity, and people prefer the in-person experience of visiting a branch and engaging with the employees. Emerging technologies augmented reality and virtual reality bridge are a gap between digital convenience and personalized service.

7. Seamless Software Integration

Using the application program interface banks, incorporate fintech products in the current banking infrastructure. The API smooth deployment reduces disruption leading to customer service issues, allowing banks to focus on day-to-day activities like new account openings, underwriting, and non-payment collections.

8. Better Cybersecurity

Financial institutions are obvious targets for hackers, and cybersecurity is prioritized. Customer assets are safer with up-to-date digital countermeasures, which increases cybersecurity by offering stringent user access limits, document encryption, and stronger firewalls.

9. More Robust Customer Solutions

Fintech provides a successful financial solution by detecting, comprehending, and satisfying consumer needs, which in a technologically advanced culture involve speed and remote access. Fintech businesses respond by expanding service offerings with add-on capabilities like online, mobile banking, and lending possibilities.

10. Improved Customer Satisfaction

Fintech revitalizes consumer happiness, making it a top corporate concern. Consumers want things to be available and to happen faster as digital solutions evolve. The banking business is no different, and to compete, financial institutions embrace fintech technologies.