Fraud Detection software tool, as its name suggests, assists users in detecting any fraud or prevents money or property from being achieved through false claims. The fraud detection software is mostly used in the banking field or the insurance domain. There are multiple fraud detection techniques used, which involves data analysis and several algorithms to detect models and irregularities. There are two ways, statistical analysis technique, and artificial intelligence. The statistical analysis technique includes calculating statistical parameters, regression analysis, probability distribution models, and data matching. There are several types of fraud, like mail fraud, credit and debit card fraud, internet fraud, healthcare fraud, bank account takeover fraud, etc. The following are the top ten fraud detection software tools in Australia with their traits.

1. Vigilance:

Vigilance is a fully-featured fraud detection application used across the globe. This application is best suited for Start-ups, SMEs, agencies, and enterprises. The best part of this application is it supports mobile devices. This software tool offers end-to-end solutions for fraud detection business problems. It is an online application that is compatible to work with Microsoft Windows operating systems and web-based platforms. The Vigilance fraud detection software offers various features, like check fraud monitoring, custom fraud parameters, internal fraud monitoring, pattern recognition, etc.

2. ThreatCop:

ThreatCop is one of the most used and robust fraud detection software tools. This software tool is ideal for start-ups, agencies, and SMEs. The ThreatCop is a machine learning and artificial intelligence fraud detection and security attack simulator tool. It enables users to get aware of the real-time threat of an organization. The features of this software include compliance management, scheduling, risk management, time scheduling, financial data protection, threat intelligence, banking, vulnerability protection, geolocation, and many others. This software offers a training module through webinars, documentation, live-person assistance, and online sessions. It is compatible to install on Microsoft Windows and macOS operating systems.

3. AUSIS – AI Underwriting:

AUSIS – AI Underwriting is another popular and fully-featured fraud detection software tool used in Australia. This software tool incorporates multiple advanced features. It is compatible to work with Microsoft Windows operating systems and the SaaS platform. AUSIS – AI Underwriting fraud detection software is used mostly in life insurance, health insurance, general insurance, and financial organizations. It offers full support 24/7 to its users. Also, it comes with a training module. There are webinars, documentation, live online sessions, and in-person assistance. Users can use this application free for some specific days. After the free trial period, users need to subscribe to $10 per month.

4. FraudLabs Pro:

FraudLabs Pro is an easy to use and powerful fraud detection software tool used widely. It incorporates analytic engines that analyze transaction parameters and report fraud analysis within less time. There are more than 50 elements for inspection. It also uses blacklist data and machine learning techniques for analyzing and reporting fraud. The blacklists data include IP address, email address, credit cards, and devices. The features of this software tool include FraudLabs Pro score, custom validation rules, FraudLabs Pro merchant area, FraudLabs Pro merchant network, email notification of fraud order, mobile app notification for fraud orders, SMS verification, social profile query, etc. It offers 500 query free per month.

5. Riskified:

Riskified is another eCommerce revenue protection and fraud detection software tool used in Australia. This software is the best tool to fix leaks in the eCommerce purchase funnel. It has an artificial intelligence platform that reduces friction and minimizes loss. The features of this application include maximizing online revenue, expanding business efficiently, machine-learning models to make instant decisions, scalable solutions to meet business needs, etc. Additionally, it includes account protection, dynamic checkout, pre-auth decisions, alternate decisions, chargeback guarantee, etc. Many businesses get benefited by using this software tool. It creates a seamless omnichannel journey to meet the needs of customers. It also enables users to track eCommerce trends in real-time.

6. Watchful Eye:

Watchful Eye is another best and popular fraud detection software tool. This software tool is best suited for small-sized and medium-sized businesses to protect themselves from errors and employee frauds. It is a web-based, cloud-based, and SaaS application. So, users can handle this tool from anywhere. Additionally, it also comes with a training module that includes webinars, documentation, and live online sessions. The features of the Watchful Eye include check fraud monitoring, custom fraud parameters, internal fraud monitoring, investigator notes, pattern recognition, and transaction approval. It offers a free trial period for some specific days. Once the free trial period completes, users need to subscribe to the monthly plan of $12.50.

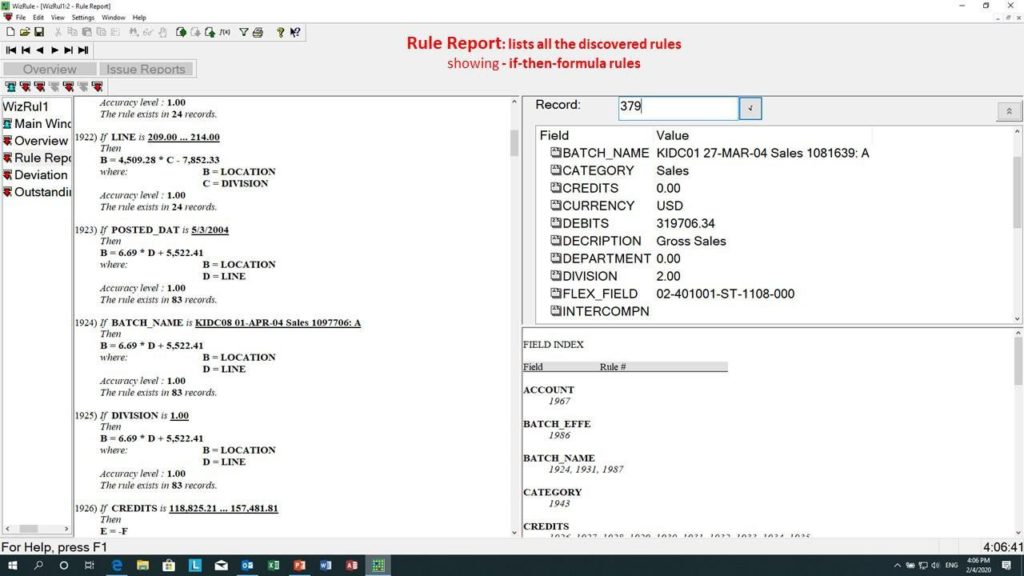

7. WizRule:

Another robust and fully-featured fraud detection software tool is the WizRule. This software tool is an innovative data auditing tool that enables users to improve data quality. There are multiple perks and benefits of using this software for organizations. The features of this application include avoiding false alarms, revealing spelling regularities, revealing outstanding rules, reports all the discovery rules, reports all cases to be an audit, reports occurrences of alphanumeric strings, etc. The Wizrule application is used, especially for data auditing, data cleansing, data quality, fraud detection, and business rules discovery. It is compatible to work with 32-bits Microsoft Windows 7 and Windows 8 operating systems.

8. Arbutus Audit Analytics: Arbutus Audit Analytics is a powerful and fully-featured application used for feud detection and audit management. It is best suited for start-ups, agencies, and SMEs. It is online audit management and fraud detection software tool used for banking, internal fraud monitoring, audit planning, compliance management, etc. This software is compatible to work with Microsoft Windows operations systems and web-based platforms. It also supports Android mobile devices. So, users can use this application anywhere and anytime. The features of this software tool include compliance management, risk management, audit planning, custom fraud parameters, internal fraud monitoring, banking, the insurance industry, and pattern recognition. It offers a free trial period for some specific days.

Arbutus Audit Analytics is a powerful and fully-featured application used for feud detection and audit management. It is best suited for start-ups, agencies, and SMEs. It is online audit management and fraud detection software tool used for banking, internal fraud monitoring, audit planning, compliance management, etc. This software is compatible to work with Microsoft Windows operations systems and web-based platforms. It also supports Android mobile devices. So, users can use this application anywhere and anytime. The features of this software tool include compliance management, risk management, audit planning, custom fraud parameters, internal fraud monitoring, banking, the insurance industry, and pattern recognition. It offers a free trial period for some specific days.

9. Fraud.net: Fraud.net is yet another leading fraud detection and preventing software tool. This software includes artificial intelligence, deep learning, collective intelligence, rules-based decision engines, and streaming analytics to detect and prevent fraud. It is the cloud-based application and is best suited for medium-scale as well as large-scale businesses. The features of this software tool include check fraud monitoring, custom fraud parameters, identity verification, investigator notes, pattern recognition, loan application screening, review recommendation, transaction approval, and internal fraud monitoring. It offers end-to-end solutions to every fraud detection problem. It is a glass-box system that offers transparent solutions for organizations to reduce risk and optimize business processes.

Fraud.net is yet another leading fraud detection and preventing software tool. This software includes artificial intelligence, deep learning, collective intelligence, rules-based decision engines, and streaming analytics to detect and prevent fraud. It is the cloud-based application and is best suited for medium-scale as well as large-scale businesses. The features of this software tool include check fraud monitoring, custom fraud parameters, identity verification, investigator notes, pattern recognition, loan application screening, review recommendation, transaction approval, and internal fraud monitoring. It offers end-to-end solutions to every fraud detection problem. It is a glass-box system that offers transparent solutions for organizations to reduce risk and optimize business processes.

10. Pipl:

Pipl is another identity verification, and fraud detection application used widely. The features of this software are robust and commendable. It offers a user-friendly, frictionless, and instantly gratifying experience. This application is one of the leading tools in its domain. The features of the Pipl include frictionless customer experience, reduced risk, automates in-process fraud detection, manual review tools for the analyst, global coverage, trusted identities are cross-referenced for accuracy and currency, rich profiles, etc. Additionally, it is mostly used for banking, insurance industry retail, identity verification, and transaction approval. This software is available at a very low cost of $0.10 per month.