Online fraud has increased the need for secure software services. Scams like sending phishing emails, fraud via fake lottery and prizes links, data leak through online payments website and others. Financial institutions are leveraging their transaction process via fraud detection software and protect people from data and privacy leaks. Moreover, the use of AI, machine learning, and deep-learning enables institutions and business to conduct real-time analysis of user’s financial activities, online browsing activities, and others. Moreover, this software provides real-time insights that will allow users to combat fraudulent activities.

1. IBM Trusteer

This tech giant offers a variety of solutions for fraud detection. Further, it uses AI and machine learning algorithms to detect fraud and prevent it from happening further. Additionally, it helps to monitor fraudulent activities, device fingerprinting, behavioral biometrics, and anomaly detection that helps to identify risks in banking and finance, online shopping, and others.

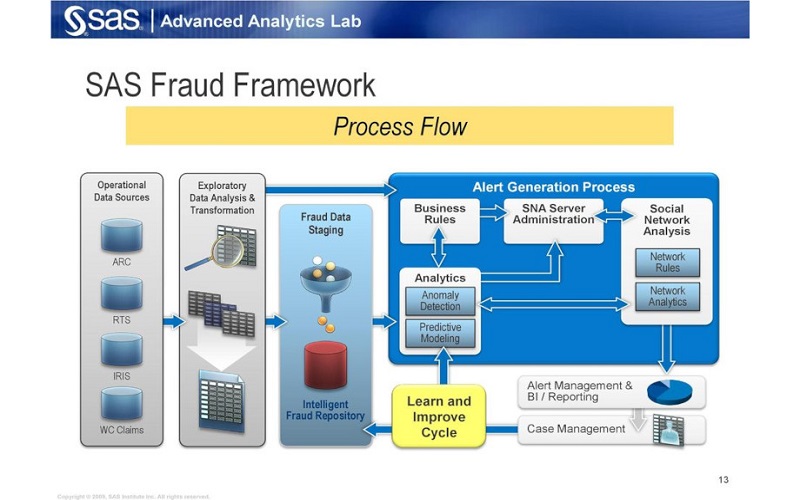

2. SAS Fraud Detection

It is a comprehensive platform used in businesses for fraud detection purposes. Further, it uses advanced analytics, machine learning, predictive modelling, and other techniques that allows in detecting fraudulent activities online. Moreover, it provides alerts and reports regarding the risks involved and helps businesses to mitigate the potential risks and protect their data.

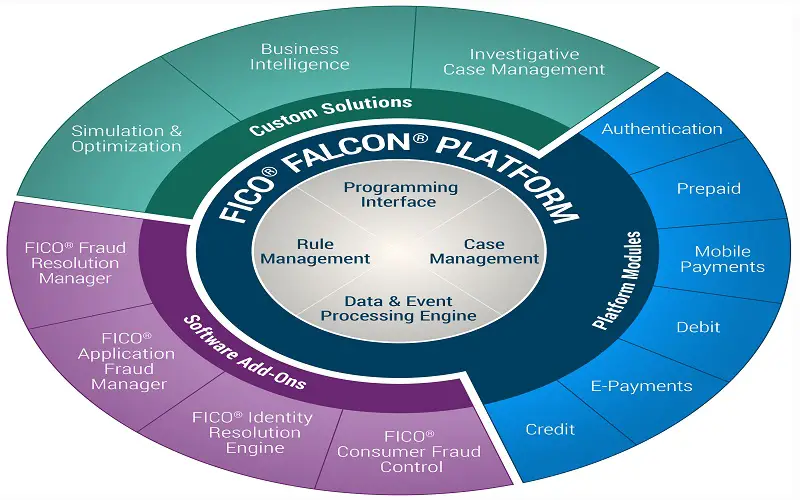

3. Falcon Fraud Manager

It helps in the detection of fraud in transaction activities through AI and ML algorithms. Further, using these models, it analyses customer’s monetary activities and financial data to identify potential threats. Moreover, the software offers case management, fraud investigation capabilities, and others that help to eliminate risks in real time.

4. Featurespace ARIC Fraud Hub

This software too, like, others uses AI and machine learning for fraud detection. It tracks customer behavior, banking and e-commerce activities, and other such data to reduce future risks. Further, it offers customized solutions and risk models that can help to combat fraudulent activities efficiently.

5. NICE Actimize

This software is specially designed for financial institutions to prevent attacks and data leaks. It uses advanced analytics to monitor and analyze economic behavior and help to detect fraud in real time. Further, it offers insights and reports based on the risk data gathered from analyzing financial activities and thus helps financial institutions to combat fraudulent transactions.

6. Experian Cross Core

It is a fraud detection and identity verification software that provides fraud detection tools to prevent future risks. Further, it uses AI and machine learning detect fraud, assess risk, offer orchestration capabilities, and others that help to eliminate identity theft and other cyber-attacks at once.

7. RSA Adaptive Authentication

It is a fraud detection software that uses behavior analytics to assess risks. It helps to detect fraud by analyzing user’s online behavior, device intelligence, transactional data, and others and helps in mitigating fraudulent activities. Further, it enables the user with risk scoring, multi-factor authentication, and adaptive policy controls that safeguard the system from unauthorized access and fraudulent transactions.

8. Kount

It is a fraud detection software that analyzes user behavior, its data, and other such sensitive information to prevent fraudulent activities. Its other features include fraud scoring, identity verification, device fingerprinting, omnichannel fraud prevention, and others that reduce cyber risks efficiently.

9. Guardian Analytics

It is a specialized and comprehensive fraud detection software for financial institutions to detect money laundering activities. It has an in-built fraud detection and anti-money laundering software that analyzes monetary transactions and alerts users about any suspicious activities carried on their financial account.

10. NetGuardians

This fraud detection is a specialized tool used by financial institutions to detect and alert unusual monetary activities in the client’s bank account. It uses advanced analytics and algorithms to gather potential attacker’s data and help to eliminate fraud. It provides the user with a set of comprehensive features such as anomaly detection, pattern recognition, and rule-based alerts that helps to identify unusual financial activities. Further, it provides reports and insights to financial institutions that help them make informed decisions and protect their customers’ valuable assets.