Hyperautomation is simply the application of Artificial Intelligence (AI) and Machine Learning (ML) tools to Robotic Process Automation (RPA) to enhance human capabilities. This results in the automation of repetitive complex tasks carried out relatively quickly and efficiently, laying the groundwork for true digital transformation. Because it can expedite complex tasks while reducing costs and increasing compliance. Because it allows the digital workforce to become more agile and increase collaboration, the current digital age is the only thing that makes corporate growth and development possible.

1. Customer Service

Businesses are searching for ways to shorten their reaction times to instantly answer customer problems and proactively deliver efficient solutions across all communication channels, given the increased expectations of customers and the importance of time. Linking the consumer to the appropriate customer care agent for a speedy resolution and engaging the customer at live touch points can drastically decrease manual labor in repetitive operations. According to research, there is room for using hyper-automation in around 70% to 80% of rules-based activities, including customer support.

2. Anti-Money Laundering

Everyone is now concerned due to the sharp increase in fraudulent activity. Businesses can prepare in advance to eliminate risks as online payments become more widespread and unavoidable by implementing robust anti-money laundering measures that use Hyperautomation solutions like AI, ML, or a combination of RPA bots. These solutions can monitor for the signs of money laundering and nip the evil in the bud to avoid potential consequences for their business and customers. RPA bots can gather and process customer-related data, pass along records to confirm interactions, carry out post-payment follow-up confirmation actions, and subsequently protect against the impending threat.

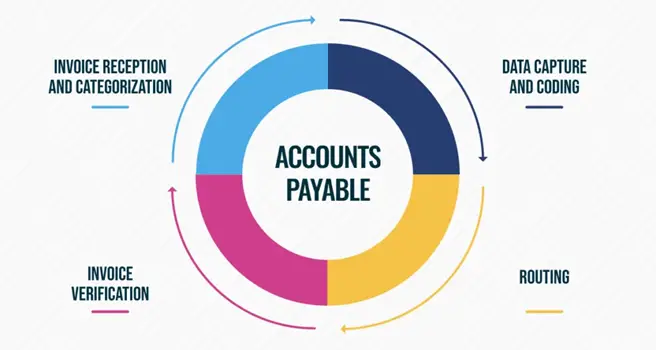

3. Accounts Payable (AP)

It involves carrying out numerous activities related to accounts payable on a large scale, which can be repetitious and time-consuming and result in delay or default. Hyperautomation, on the other hand, has made it possible to streamline the procedure by standardizing invoicing formats and combining all accessible data into a single data system. Pre-existing RPAs benefit from inputs from ML and document extraction technologies like optical character recognition (OCR), allowing them to successfully facilitate the AP process from reception to payment without outside assistance. It works in the following way: RPA automatically processes invoices received and is then prepared using OCR. RPA will then coordinate data entry, error correction, and other necessary actions to process the invoice without human involvement.

4. Recruitment

The recruitment industry is another area where hyper-automation can significantly streamline the procedure. Finding resumes for various profiles from various platforms at different timestamps by business requirements is a practical, low-cost, and time-saving method. Based on the pre-faded parameters, it can take over duties that currently require manual labor, such as sorting through spam, identifying candidates for the organization, and filtering out unwanted applications. As a result, it may structure and simplify the hiring process considerably, relieving recruiters’ stress, assisting with time-consuming duties, and freeing up time for better application and applicant analysis in other methods.

5. Lead Generation

Most firms are picky about their marketing strategies to widen their audience, emphasizing how crucial and challenging lead creation is. Because users typically prefer not to divulge their personal information, Hyperautomation can allow businesses to track visitors’ actions on their websites or app by recording their IP addresses and other pertinent information about incoming traffic. This information is automatically saved and directed into a platform for outreach, where it is shared with the appropriate individuals in the various departments for further action. Additionally, the filtration of the intended audience from the incoming traffic is made more straightforward, and services tailored to businesses are improved for higher sales. Companies can interact with these profiles with little effort by automatically advertising to a defined group of target audiences. The entire procedure is automated up until the sales rep answers.

6. Technology Integration And Advanced Analytics

Hyperautomation offers the groundwork for successfully integrating analytical, operational, and storage tools that make any process relatively robust, especially as enterprises increasingly adopt hybrid-cloud or multi-cloud infrastructures. A hyper-automated arrangement can enable a company to interact quickly and assist companies in accessing and analyzing previously unreachable data to acquire crucial organizational-level insights. Additionally, the RPA technologies may transform unstructured data into a structured form that can then be exposed to unsupervised ML algorithms for pattern identification and insight extraction.

7. Data Storage

The successful execution of data extraction, verification, sorting, classification, and storage in various forms and categories by the requirements and usage in the organization is made possible by hyper-automation. The workforce is freed from manual tasks where correctness is one of the primary checkboxes, making the data accessible seamlessly and less time-consuming. It automatically forwards data unique to the various departments when processing the original data is finished. In such labor-intensive jobs, hyper-automation and RPA bots greatly impact and can significantly reduce repetitive tasks.

8. Loan Underwriting

RPA & AI can also automate the underwriting process for loan transactions. Assemble the information from both internal and external sources. Analyzing past client transactions and offering pricing & interest choices

9. Banking Customer Onboarding

Due to know-your-customer (KYC) standards, customer onboarding in banking is a document-intensive process. The procedures comprise identity verification, client due diligence, screening, scoring, reporting, and account activation. Human-in-the-loop and machine learning models to enable verification and validation of information intelligent bots are trained by historical data to improve their accuracy. Using these methods, pre-trained bots extract information from documents, input data into their systems, and build risk profiles.

10. Customer Service Operations

The end-to-end automation of satisfying straightforward consumer requests involves technologies: Machine learning algorithms categorize customer requests and link them to appropriate actions. NLP: Understanding customer input