In the present digital era, the User Experience (UX) and User Interface (UI) design are behind any product or website’s success in the market. Developing an interactive and seamless user experience helps in retaining maximum users while attracting new customers. It also provides a sense of security and loyalty to the customers and other partner brands to increase the business. An ideal user experience is achieved by sticking to already-established principles that help in the design process. In this article we will learn about the Top 10 UX/UI Principles that can help boost the user experience efficiently:

1. The Rise Of Contactless Payments

Contactless payments are getting popular at an exponential rate especially in India, as they are much more convenient than the usual contact-based transactions which involve entering the account information physically. It enables users to make payments by tapping or hovering over their card or mobile device on a contactless platform or panel specially designed for this purpose. This particular type of payment process is becoming widely accepted throughout the world. This is evidenced by the fact that major retailers and restaurants now offer contactless payment services to increase convenience.

2. The Growth Of Mobile Wallets

Mobile Wallets are one of the popular digital payment methods now which allow users to store their payment credentials on their respective smartphones or tablets. The transaction then uses this information to make payments either online or in-store. Mobile Wallets are getting an increasingly larger user base since they provide numerous advantages over general payment methods, such as ease of transaction, fast payment, security, and rewards.

3. The Emergence Of Cryptocurrency

Cryptocurrency refers to a digital or virtual repository of currency that uses cryptography as an encryption method for security. It is not accountable to a government or any financial institution’s control so it is used to carry out anonymous payments online without revealing identity. Although many countries have introduced laws that levy tax on such transactions to regulate such transactions, it is the most common transaction method for doing illegal stuff. It is still a relatively new meta, but it is gaining friction among a wide group of users.

4. The Rise Of Buy Now, Pay Later (BNPL) Services

The BNPL services provide consumers the flexibility to purchase goods and services initially and pay for them later in structured installments. This is often carried out without any interest imposed to target a huge consumer base that is not able to pay the entire amount at once. These services are increasingly acquiring a large mass of crowd for their convenient and affordable approach to payments.

5. The Increasing Use Of Artificial Intelligence (AI) And Machine Learning (ML) In Digital Payments

Artificial Intelligence can be trained on a large database to use it as a tool to detect fraud in digital payments along with Machine Learning technology to enhance its power. It improves the user experience by personalizing it to their needs and by assessing the risk in any transaction triggered by the user. These software are easily integrated with the payment interface due to recent developments and user experience in AI technology.

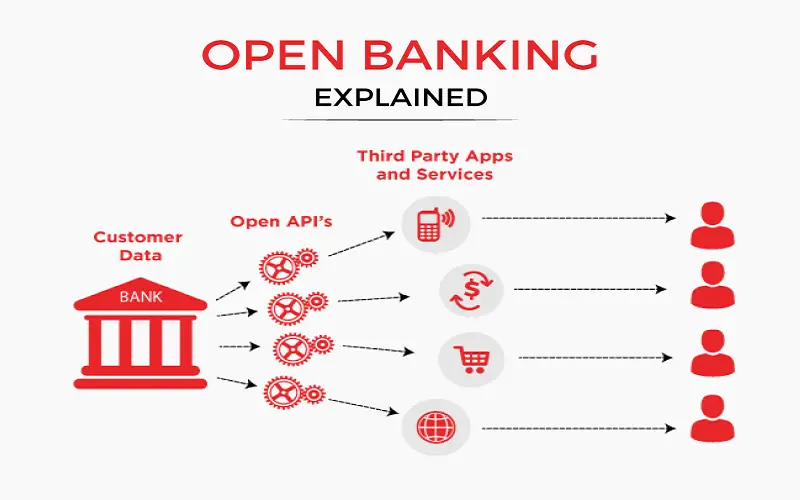

6. The Growth Of Open Banking

Open Banking brings a new approach to the table by enabling third-party services to access customer data with their consent. Open Banking possesses a great potential to revolutionize the businesses and financial services industry, as it can provide a pathway for innovative products and services in the market.

7. The Rise Of Embedded Finance

Embedded Finance is the blend of financial services and non-financial products and services to generate more revenue. For example, a customer purchases a product and along with that, it is possible to finance that product from within the same interface at the time of checkout. It can even be used to purchase insurance within a travel app or a car dealer’s site. This is a growing trend which gives customers and businesses plenty of advantages over the usual ways.

8. The Increasing Use Of Blockchain Technology In Digital Payments

Blockchain is a ledger technology that is distributed and used for secure and transparent transactions. It provides an advanced database mechanism to enable the transfer of information transparently within a shared business network. It is the future of digital payments which is growing rapidly to revolutionize the way we do our payments regularly. Its ability to carry out a faster, cheaper, and more secure payment makes it a more feasible choice among the other technologies.

9. The Rise Of Central Bank Digital Currencies (CBDCs)

CBDCs are digital currencies that are prominently issued and regulated by the central banks of the country. Despite being similar to Cryptocurrencies, their value is fixed by a central body or bank which is comparable to the country’s fiat currency. The pandemic has accelerated the drop in the use of physical currency which is still widely accepted however this has led different bodies to develop various digital currencies. CBDCs are capable of transforming the global financial system since they have a proper managing and regulating system governed by the central banks.

10. The Increasing Focus On Financial Inclusion

Financial Inclusion refers to the ability of all individuals and businesses to tap into financial services of all sorts. Innovative products and services offered by the Digital Payments and Fintech industries play an important role in promoting financial inclusion. These services are available to a wide range of people with different needs and belonging to different sector and in turn ensures that all part of the underserved and marginalized population have access to such affordable and flexible services.