One of the biggest obstacles for investors when it comes to cryptocurrencies is not falling victim to the hype. Investors are still being advised by analysts to beware of cryptocurrencies’ high volatility and unpredictable nature. As with any other investment, conducting research is crucial if you’ve decided to invest in the cryptocurrency market. To better assess whether this kind of investment opportunity is useful for you, think about why you are interested in this particular investment vehicle and educate yourself on cryptocurrencies and blockchain technology.

1. Avoiding Falling Into The Hype

One of the biggest obstacles for investors when it comes to cryptocurrencies is not falling victim to the hype. Digital currencies have become increasingly popular among institutional and ordinary investors alike. Analysts have also kept reminding investors of the volatility and unpredictable nature of cryptocurrencies.

2. Consider Why You Are Investing In Cryptocurrency

Before investing in cryptocurrencies, you should probably ask yourself why you’re doing it, which is perhaps the most important question to ask. Numerous investing options exist, many of which provide more stability and lower risk than virtual currency.

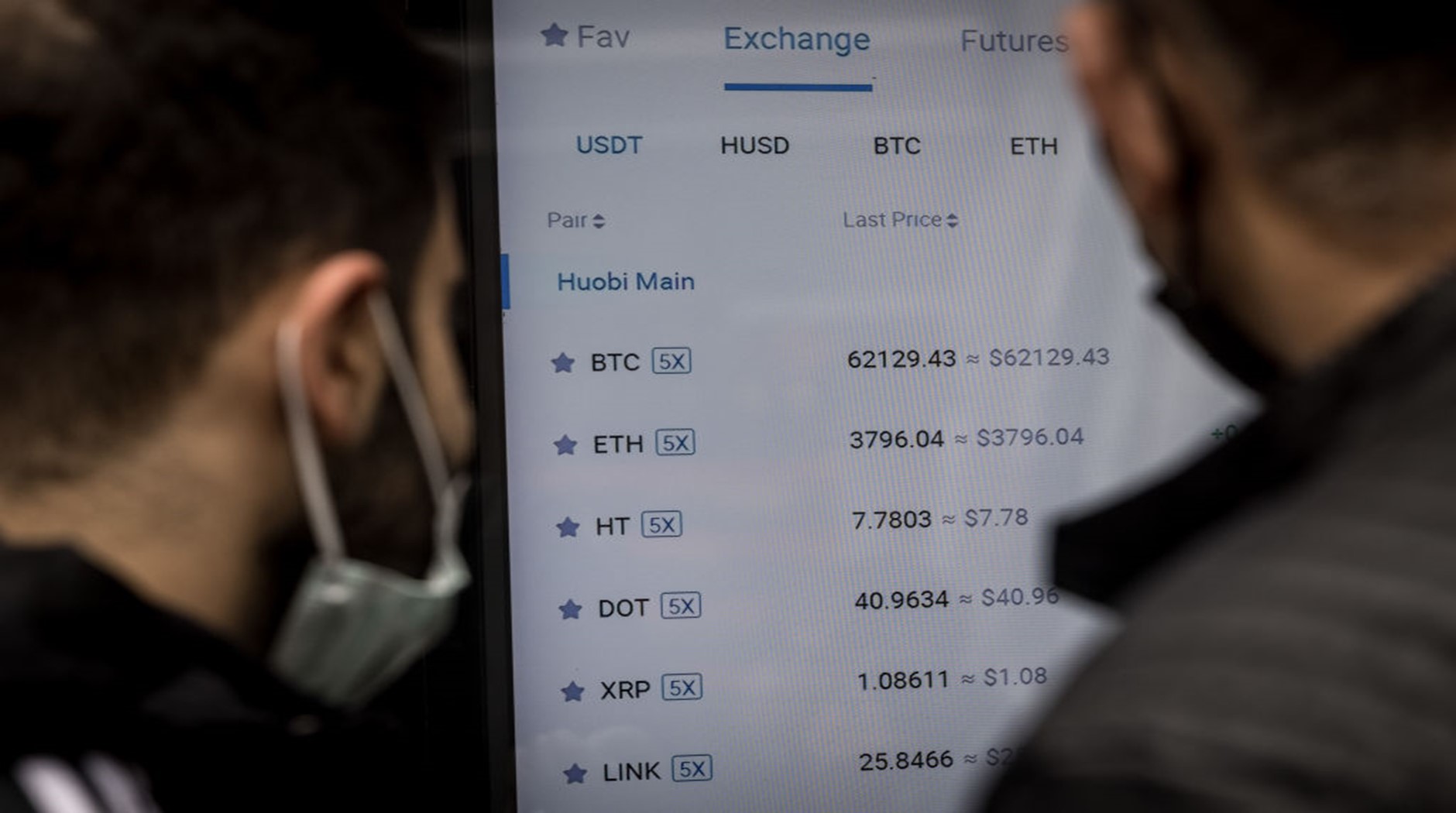

3. Get A Feel For The Industry

Before investing, investors must understand how the world of digital currencies functions, especially those new to them. Study the various currencies on offer in detail. It’s important to look past the most well-known currencies and tokens, such as Bitcoin, Ether, and Ripple, given the large variety of coins and tokens now on the market.

4. Become A Member Of A Cryptocurrency Community Online

As a result of the trendy nature of the digital currency industry, things frequently change and advance swiftly. A large and very active community of investors and lovers of digital currencies is in constant communication, which is one of the causes.

5. Read Cryptocurrency White Papers

The characteristics of digital money are more significant than word of mouth, though. Find the project’s white paper while you are thinking about investing. Every cryptocurrency project ought to have one, and it ought to be simple to access (if it isn’t, consider it a warning sign).

6. Timing Is Key

You have probably gained an understanding of the cryptocurrency market after thorough research, and you may have chosen one or more projects to invest in. Time your investment is the next stage. The field of digital currencies is notorious for its rapid movement and significant volatility.

7. Use A Trustworthy Wallet

You must conduct some research to find the greatest wallet for your requirements. If you choose to handle your bitcoin wallet locally on your computer or mobile device, you must protect it at a level commensurate with your investment. Just like you wouldn’t carry a million dollars around in a paper bag, don’t put your bitcoin in an unpopular or obscure wallet. If you want to stay out of trouble, choose an established wallet.

8. Have A Backup Strategy

Have a fallback plan. Consider what would happen if your computer, phone, or other storage location for your wallet were to be lost, stolen, or otherwise inaccessible. You won’t be able to recover your bitcoin without a backup plan, which means you risk losing your investment.

9. Beware Of Scammers

Cryptocurrency exchanges are vulnerable to hacks that could result in the permanent loss of your money; fraud is a persistent concern with cryptocurrency. Scammers frequently use social networking sites like Instagram, Facebook, and Twitter to lure victims into making these purchases. You should immediately contact national reporting organisations if you believe you have been targeted.

10. Coded String Of Data

A cryptocurrency is a coded string of information that represents a unit of exchange. Blockchains are peer-to-peer networks that act as secure transaction ledgers while also keeping track of and organising bitcoin transactions like buying, selling, and transferring. Cryptocurrencies can function as money and an accounting system by using encryption technology.