It used to buy and sell products rather than notes and money. It is in the owner’s digital wallet via an online exchange. Bitcoin distinguished by blockchain technology. It’s based on a complex online network distributed across numerous computers, making counterfeiting and double-spending impossible. It exists independently of governments and central banks, allowing digital currencies to maintain and value by their users.

1. Trading

Investing long-term strategy of buy-and-hold trading capitalizes on short-term possibilities. The bitcoin market is volatile. Asset values rise and decrease in a short time. It has technical and analytical abilities to be a good trader. Trading cryptocurrency pairings such as BTC USDT based on market trends and technical analysis is an approach to generating money. This entails analyzing charts and using indicators to forecast future price changes.

2. Traditional Buy And Hold

Obtaining crypto assets from a crypto exchange and acquiring them when prices fall is called buying the dip. The support is sold years later at a considerable profit over the acquisition price. Bitcoin, Ethereum, and Litecoin experienced daily expense fluctuations. New currencies debut at a greater price because of the buzz. It loses value over time and takes time to recover.

3. Airdrops

Airdrops is best for cryptocurrency aficionados for free tokens without spending money. Airdrops don’t require the customer to make a deposit, and spend money in advance. The stages of airdrops are sharing project information on social media, joining an online community and doing simple activities.

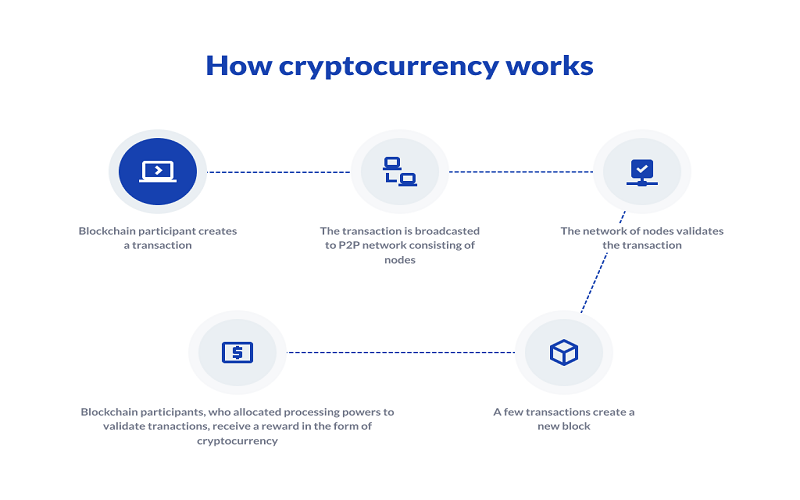

4. Mining

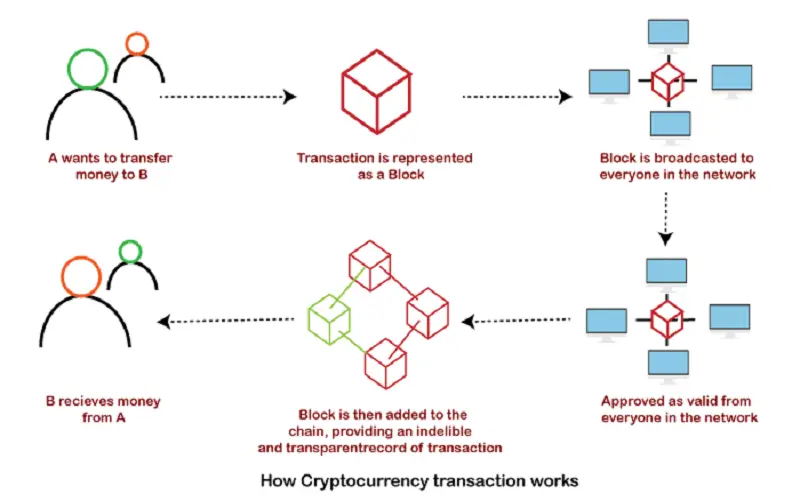

Mining is a popular technique to profit from cryptocurrencies. Mining is validating blockchain transactions and adding new data blocks to the chain. Miners compensate with Bitcoin for labor. Mining done with specific gear and cloud mining services. Cloud mining does not necessitate the purchase and upkeep of hardware, and the benefits are lesser than those obtained by hardware mining.

5. Buying, Selling, And Storing

The user purchase and sell cryptocurrencies from the central exchange, brokers, and individual currency owners. The simplest way to purchase and sell cryptocurrencies is through sales or websites. Cryptocurrencies are held in digital wallets once purchased. When a wallet is hot, it is linked to the internet, making it easier to transact, prone to theft and fraud. Cold storage is safer but makes transactions difficult.

6. Transacting Or Investing

Bitcoin is moved from a digital wallet using a smartphone. It’s spent on products, and services, exchanging and converted to cash-the simple to use Bitcoin for purchases through debit-card-type transactions. The debit card used to withdraw some money like an ATM. It is feasible to convert Bitcoin by utilizing a banking account and peer-to-peer transfer.

7. Earning Interest

You earn income on assets using cryptocurrency. It’s done via a yield farming process, in which you lend Bitcoin to a platform in return for interest. Yield farming is a dangerous and a tremendous source of passive income. The venue and the type of Bitcoin lent influence the amount of interest.

8. Dividends

The dividend is a method of profit from the crypto investment. It’s invested in stocks and bonds; you are familiar with of dividends. Dividends are small cash payment provided to shareholders. If a firm produces money in a quarter the earnings is divided and returned to the company owners.

9. Lending

Lending is to monetize cryptocurrency. It involves Bitcoin in return for interest. The type of cryptocurrency and the quantity lent affects the interest rate. The three types of lending platforms are decentralized, centralized, and peer-to-peer lending.

10. Investing

Investing in cryptocurrencies is a method to earn. You purchase individual currencies like Bitcoin and Ethereum and invest in a cryptocurrency index fund. It is a way to diversify the portfolio and spread risk. It investigates and appreciate the hazards involved before investing in cryptocurrencies.