With the advent of the latest technology, the banking enterprise has modified pretty over the years. Now, the banking techniques are plenty quicker and dependable which has caused progressed client courting with banks. For instance, MasterCard Advisors, the statistics analytics and insights arm of MasterCard distill enjoy and information from heaps of real-global engagements with monetary establishments to generate precious techniques throughout Consumer, Commercial, Debit, Credit, etc.

Rising Technology In The Banking Region

Robotic Process Automation

The extent of unstructured statistics that the banks need to manner is developing exponentially with the upward thrust of the virtual economy. These aren’t simply banking transaction statistics, however, additionally different behavioral statistics might permit banks to enhance and innovate so that the client can enjoy. With an aggregate of diverse technology that permits cognitive and robot manner automation bankers can now apprehend client motion and make a judgment at a better speed, scale, and quality.

Data Analytics

Today, fulfillment is executed via way of means of riding sensible client engagement primarily based totally on a statistics-pushed knowledge of the commercial enterprise. Technology and digitization have converted the BFSI region via way of means of allowing them with real-time actionable insights to make knowledgeable decisions, growing aggressive benefits, and raising patrons to enjoy. This additionally lets in banks to percentage ability products, upsells, cross-sells, and strategic making plans with clients.

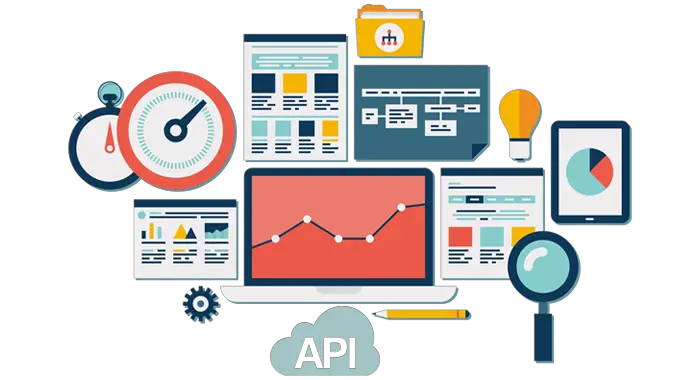

API Platforms

Today, thru API platforms, banks are operating with Fin techs to construct banking stacks that permit them to be a platform on which clients and third-celebration carrier carriers can hook up with supply bendy and customized studies to the give up-user. API Banking Platform is designed to paintings thru APIs that take a seat down among the banks’ backend execution and front-give up studies supplied via way of means of both the financial institution itself and third-celebration partners.

Cyber Security

Banking enterprise offers sensitive & private information, which has made it an appealing goal for cybercriminals. With the deployment of the era inside the BFSI region, the cyber hazard is likewise evolving. The banks are getting agile with the manner they method cyber security. They are regularly imposing superior analytic, real-time tracking and biometrics, and behavioral evaluation software programs to hit upon threats and prevent them from disrupting the systems.

Cloud Computing

Another technological development this is revolutionizing the banking enterprise is cloud computing. Cloud is an important device of the carrier shipping version and allows banks to penetrate new commercial enterprise possibilities and get admission to new shipping channels. By leveraging cloud-primarily based services, banks can lower statistics garage expenses via way of means of saving on capital and running expenditure, whilst making sure client statistics is protected.

Future of Retail Banking

Technology geared in the direction of enhancing retail banks’ operational performance is undoubtedly impacting the market. According to Insider Intelligence, 39% of retail banking executives say that lowering expenses is wherein era has the best impact, in comparison to handiest 24% who say it is enhancing client enjoy.

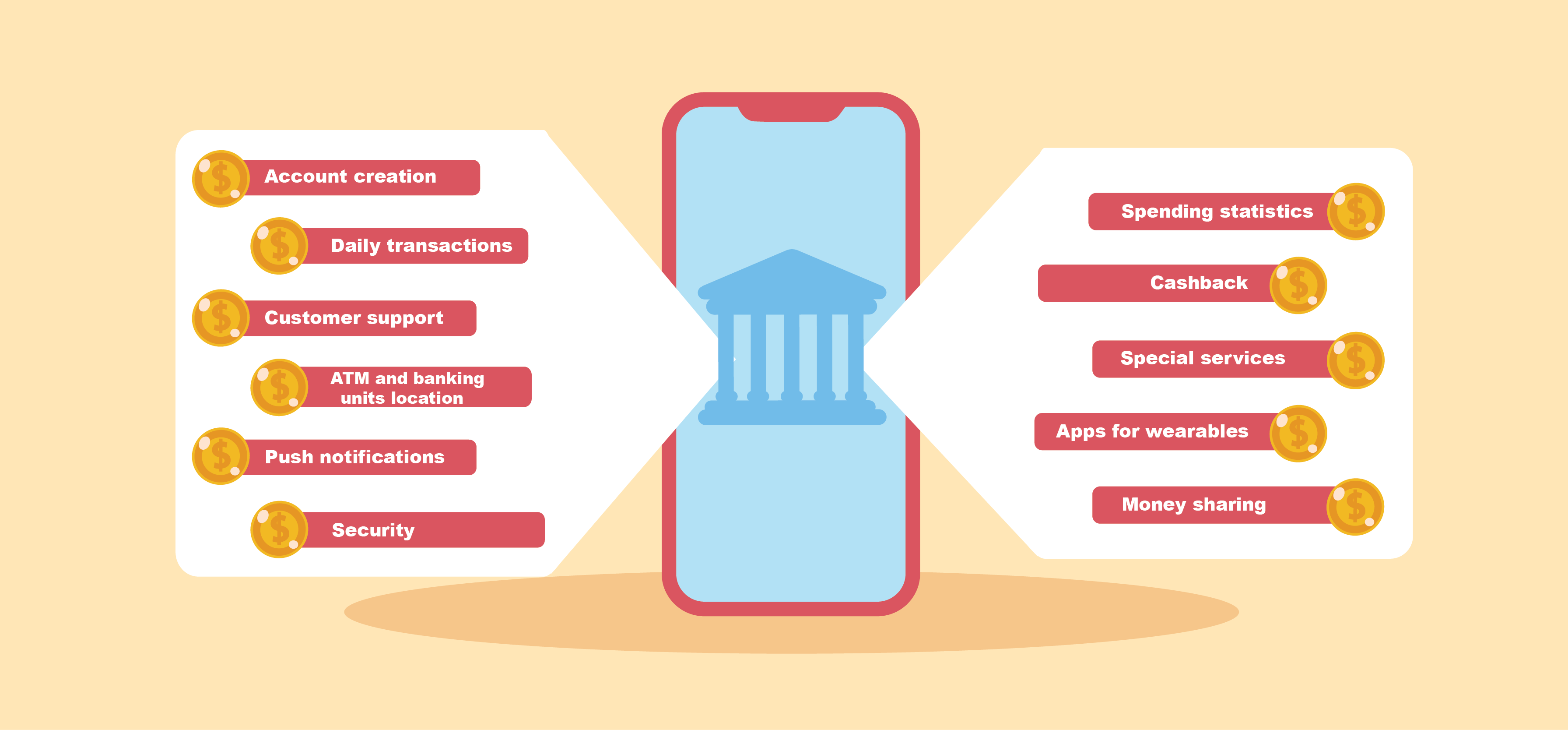

Future of Mobile Banking

Mobile banking has come to be the go-to technique for customers to make deposits, account transfers, and display their spending and earnings—and a key differentiator for banking leaders. Nearly 80% of our survey respondents who’ve used cellular banking say its miles the number one manner they get admission to their financial institution account. Online banking, which incorporates cellular banking, refers to the general enjoyment of banking thru virtual channels, consisting of cellular apps, desktops, stay chatbots, and extra.

Future of Online Banking

The reputation of cellular banking has passed that of online banking, and the general wide variety of online clients has slowed worldwide. According to Insider Intelligence, cellular banking is developing at 5 instances the fee of online banking, and 1/2 of all online clients also are cellular banking customers.

Future of Digital Online Banks

Sophisticated cellular banking gear is a pinnacle aspect fueling US nonbanks’ stratospheric upward thrust—one it’s taken on extra significance amid COVID-19. Incumbent monetary establishments, nonbanks, and tech corporations alike can advantage from knowledge of precisely how main nonbanks are elevating the bar for client expectancies and consider effectively scaling their groups.

Banking Technology Trends

The destiny of the banking era is pushed via way of means of consumers, mainly Gen Zers, who see the era as something that complements their lives. A not unusual place fashion in the banking era is the use of a software programming interface (API) to make proprietary statistics to be had to everybody who has the patron’s permission to get admission to it. APIs may be used to permit a financial institution’s cellular app to drag down client account information. Fin techs have extensively utilized the API era to permit their groups to paint, and their fulfillment is encouraging competition to expand their very own APIs.