How VoIP & IP Messaging Give Hard Time to Mobile Operators

Recently Operator feels discomfort and threatens by VoIP & IP Messaging service from OTT player’s movement in the market. Over the top player the one who provides the service and gain revenue by using network operator infrastructure. Meanwhile, The OTT players gain very high revenue from their service without any fee commitment with the provider, operators are having hard time in providing the broadband infrastructure from abusive way of data consumption.

There are two types of OTT services – content services, which are offered by a broadband connection and communication services. While, the former only represent competition to the operators to the extent that they would like to provide these services to, the latter are in direct competition with the operators’ core business.

OTT-communication services have existed for a long time and have usually focused on providing low-cost calls; usually international calls and less often national calls. The first incarnation of OTT services used to run low-cost voice on the top of existing voice services typically by using call back, free toll numbering and international dialing codes.

In the fixed-line world, OTT communication has existed since the mass proliferation of the Internet and it did arguably contributed both to eroding voice revenues and helping to push further Internet adoption. The mobile world today is facing the same issues that the fixed world has been facing for over a decade, telephone lines are turning into Internet connections, phones are turning into computers. As has already been observed in the fixed-line world, we are now witnessing a direct correlation between Smartphone adoptions (the equivalent of what was PC adoption) and the adoption of OTT-based IP-communication usage. Consumer behavior is changing and mobile operators’ voice and messaging are consequently being eroded.

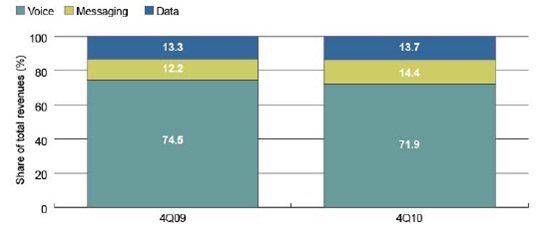

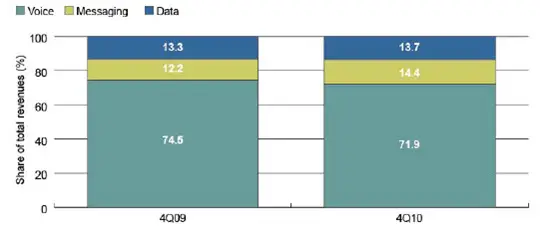

Figure 1. Western Europe overall mobile operator for voice, messaging and data service revenue

While, The OTT-based communication services are not fully appreciated by operators, they believes that the issue should be treated as a very high priority because of the size of the potential revenue loss and because operators risk losing visibility of their customers who, in turn, could lose interest in their service providers.

The size of the potential revenue loss is large and the theoretical addressable size of OTT communications services is the operators’ entire messaging and voice traffic; in reality the size is much smaller, but there is clear evidence that voice and messaging revenues are being cannibalized with free or very low-cost OTT services. Figure example has been taken from European SMS and voice revenues in order to calculate the potential revenue losses for the years to come and to provide a snapshot of potential losses.

From the figure above does not fully reflect the extent to which customer behavior might change in the future, and also to the extent to which additional penetration of Smartphone will amplify the addressable base of OTT communication, the more the customers’ connections have access to OTT communication, the more they are likely to use OTT to communicate rather than using the operators paid-for services. What we see so far from the consumer side, revenue erosion derived from OTT tends to be specifically related to the youth and tech-savvy segments of the customer base.