Adsense question on payment approvals

Hi All,

Adsense question on payment approvals.

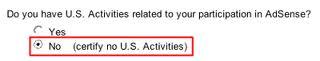

I get this message. I am from India. Now Tax information what should i enter ? is this applicable to me as i am not US citizen?

https://support.google.com/adsense/forum/AAAAKDuOfxQWI9S8wb_ZaQ?hl=en

The above link is what it routes me to

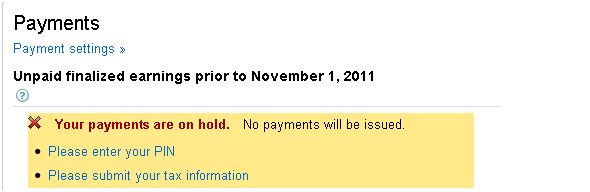

Payments

Your payments are on hold. No payments will be issued.

Please enter your PIN

Please submit your tax information

Regards